Mwananchi Credit – the micro-finance organization specializing in logbook loans, car loans, and civil servant check-off loans – has launched #ResponsibleBorrowing campaign. Through the initiative, the company aims to raise public awareness on personal finance planning, debt management and the importance of responsible borrowing in achieving financial stability.

Debt can be a powerful tool when used wisely, enabling individuals to overcome financial challenges and restart their lives. However, Mwananchi Credit acknowledges that debt can also become burdensome if not managed responsibly. As a responsible lender, Mwananchi Credit believes that debt should serve as a servant, not a master.

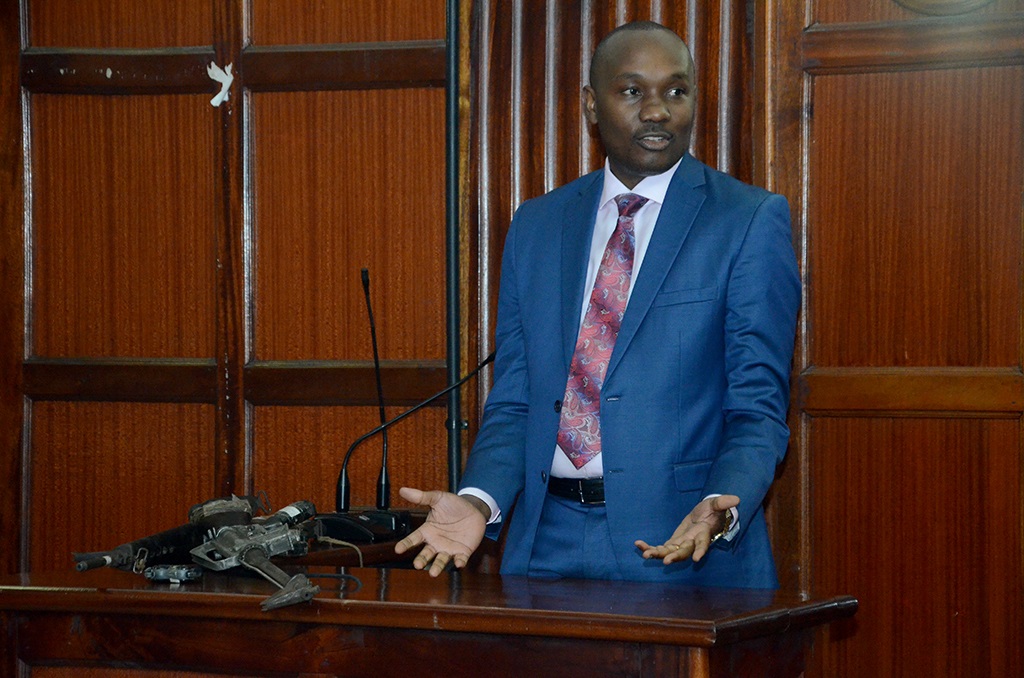

Speaking during the launch of the program, Mwananchi Credit General Manager Miriithi Gitonga said the #ResponsibleBorrowing campaign will encompass a comprehensive public education programme focused on providing individuals with the necessary knowledge and tools to make informed financial decisions.

“Through extensive and intensive awareness initiatives,” Mr Gitonga said, “the campaign aims to empower individuals with practical skills for effective personal finance management and debt handling.”

During this campaign, dubbed #BorrowNaPlan, Mwananchi Credit will also highlight success stories of borrowers who have benefitted from their loans, showcasing real-life examples of how responsible borrowing has positively impacted lives. These stories will serve as inspiring testimonials, demonstrating the potential of well-managed debt to create opportunities and promote financial well-being.

Moreover, Mwananchi Credit seeks to differentiate responsible lenders from predatory lenders within the micro-finance sector. The campaign will emphasize the ethical practices and transparent policies employed by Mwananchi Credit, ensuring borrowers’ best interests are prioritised.

Read >> Saving And Investing Guide For Employed And Self-Employed

By highlighting the role of microfinance organizations in the loan market, Mwananchi Credit aims to build trust and encourage individuals to seek financing from responsible lenders.

As part of the #ResponsibleBorrowing campaign, Mwananchi Credit invites individuals, financial experts, and community leaders to join hands in spreading awareness about prudent debt management and the importance of making informed borrowing decisions.

By empowering individuals with financial knowledge and promoting responsible borrowing practices, Mwananchi Credit hopes to contribute to building a financially secure society where loans act as stepping stones to success rather than traps. “Together, we can foster a culture of responsible borrowing and ensure that debt remains a tool for progress and financial freedom,” Mr Gitonga said.

See Also >> Build Wealth Through Goal-Based Saving Strategy

Leave a comment