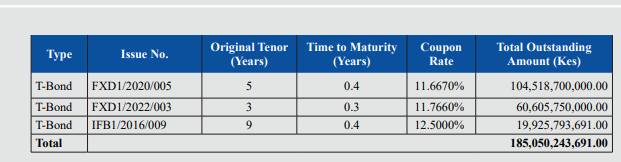

The Central bank of Kenya (CBK) is in the market offering to buy back the following domestic bonds before their maturity in April and May 2025.

Imagine bonds worth Ksh185 billion maturing in two months. This is equal to an entire month’s tax revenue collections. And there will still be T-Bills maturing over the same period.

This indicates the fiscal pressure the debt burden is imposing on the country. We can’t continue borrowing the way we are doing and avoid a serious economic crisis. This refinancing isn’t guaranteed to work, especially in the event of an economic shock.

The interest burden is another story altogether. In the first five months of the current financial year, we spent an equivalent of 48% of tax revenues on debt interest. We need to balance our budget and take concrete measures to bring the debt down.

![Parliament in a past session. [Photo/Parliament of Kenya/Facebook]](https://businesstoday.co.ke/wp-content/uploads/2026/02/Parliament-Kenya-200x143.webp)

Leave a comment