The Central Bank of Kenya (CBK) has announced the publication by Gazette Notice No. 55 of April 8, 2020, of the Credit Reference Bureau Regulations, 2020 (CRB Regulations).

These CRB Regulations were issued pursuant to Section 31(3) of the Banking Act and replace the Credit Reference Bureau Regulations, 2013. The CRB Regulations provide for the licensing and supervision of Credit Reference Bureaus (CRBs) by CBK.

Importantly, they also provide a framework for the exchange of borrowers’ credit information between commercial banks, microfinance banks, Savings and Credit Societies (SACCOs), other credit information providers approved by CBK, and CRBs. They are now operational.

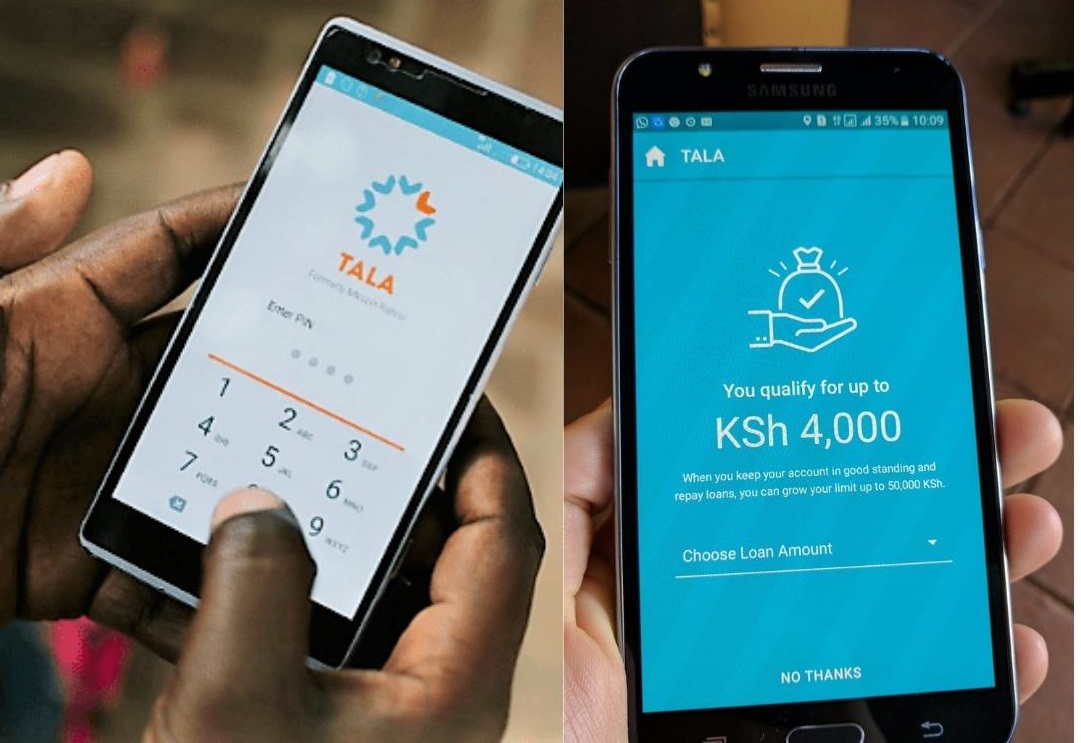

See: Pain of Mobile Money Loans Drives Tala Down Road Less Travelled

The revised CRB Regulations have been developed through a consultative process that started in 2018, and are intended to strengthen Kenya’s Credit Information Sharing System (CIS) that has been operational since 2010.

In particular, they seek to enhance consumer protection for borrowers, expand the sources of information and ensure the sustainability of the CIS as a key tool to bridge the information gap about the borrower’s creditworthiness.

The key reforms introduced by these CRB Regulations include setting a minimum threshold of Ksh 1,000 for negative credit information that is submitted to CRBs by lenders.

Therefore, borrower’s information regarding non-performing loans of less than Ksh 1,000 will therefore not be submitted to CRBs, and borrowers that were previously “blacklisted” only for amounts less than Ksh 1,000 will be “delisted.”

See: Digital Footprint a Danger to Your Safety, Loved Ones

In addition, first-time CRB clearance certificates will be provided by CRBs at no charge. This is particularly beneficial to Kenyan youth and graduates who are seeking employment.

“SACCO societies regulated by the Sacco Societies Regulatory Authority (SASRA) have now been included as authorized subscribers of credit data to CRBs. These SACCOs will now submit borrowers’ information to CRBs and also receive credit reports directly from them,” notes the communique from CBK.

In addition to publishing these CRB Regulations, additional measures that have been implemented have seen the CBK withdraw the approvals granted to unregulated digital (mobile-based) and credit-only lenders as third party credit information providers to CRBs.

The withdrawal is in response to numerous public complaints over misuse of the CIS by the unregulated digital and credit-only lenders, and particularly their poor responsiveness to customer complaints.

“Thus, unregulated digital and credit-only lenders will no longer submit credit information on their borrowers to CRBs,” adds the statement.

On the recommendation of CBK, the Cabinet Secretary for the National Treasury and Planning has published by Gazette Notice No. 3096 of April 8, 2020, the suspension for a period of six months, the listing of negative credit information for borrowers whose loans were performing previously but have become non-performing from April 1, 2020.

It adds, “Consequently, loans that fall in arrears from April 1 to September 30, 2020, will not lead to the “blacklisting” of the borrower on the CRBs. This is one of the emergency measures that were announced on March 25, 2020, in light of the exceptional circumstances from the Coronavirus pandemic and aiming to shield borrowers from the adverse impact.”

This is good news to many Kenyans who have been barred from accessing credit and with the new regulations, the playing field is now being levelled out.

Leave a comment