If you go out on the streets and ask a dozen people whether Williamson Tea Kenya Plc (WTK) shares are a good investment, there is a good chance that you would get a dozen different answers. Investors come to the stock market with different financial goals. For that reason, each would have different ideas about what they think is a good investment.

Instead of imposing on you that Williamson Tea is a good company to invest in, we decided to put the company under the microscope to help you see what is in it and if you would like it. Before getting into the details about whether Williamson Tea is a good company to invest in, it would help to nail the basics first.

>> John Kimani: The Investor with a High Appetite for Safaricom Shares

People invest in company shares to make money. You can make money with shares in two ways: capital gains and dividends. A capital gain occurs when you sell your shares at a profit. Let’s say you bought shares of a company at Ksh10 apiece. If the shares go up to Ksh15 and you decide to sell, you would realise a capital gain of Ksh5 on each share. Capital gain is the primary way investors make money on the stock market.

Dividends are payments that companies distribute to their investors. Some companies pay you simply for being their shareholder. They set aside money from their profit to give back to their shareholders. That payment is called dividend. But not all companies pay dividends. Dividend payment is associated with profitable and established companies.

Investing in company shares has another benefit apart from capital gains and dividends. You may use your shares as security to borrow money from a bank. That’s it for the basics. Now let’s now return to Williamson Tea to see if you would want to invest in this company.

What does Williamson Tea do?

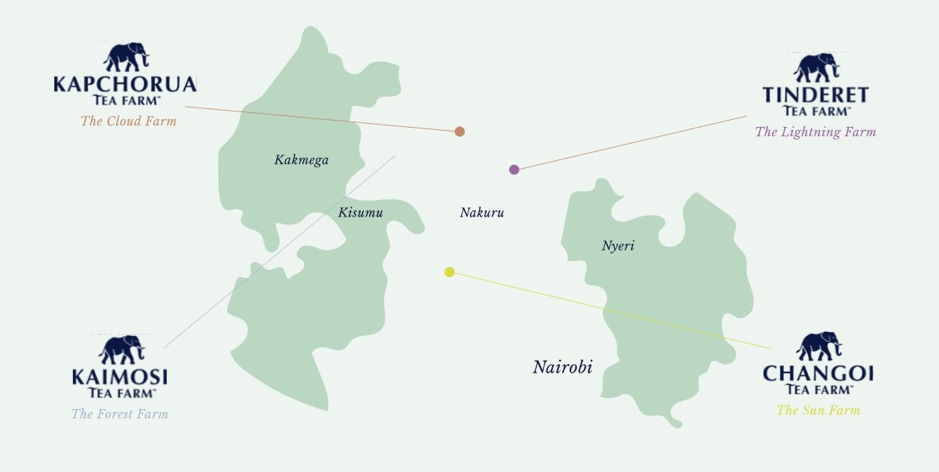

You guessed it right from the name. Williamson Tea is in the tea business. The company grows and processes tea for sale in domestic and international markets. It operates tea farms in Kaimosi, Kapchorua, Tinderet and Changoi.

Williamson is the company behind popular premium tea brands such as Duchess Grey, Mint Garden, Lifeboat Tea and Purple Blush. The company has been in the tea business since 1869. That tells you that Williamson is a tea expert. It knows how to produce tea that sells and where to get the market for its products.

Is Williamson Tea a profitable company?

The short answer is yes. But that is better explained. Williamson Tea has been profitable for most of the years it has been in the tea business. But it has ended up with losses in some years. The chart below shows Williamson’s profit and loss profile going back to 2013.

Something important to keep in mind as you study the chart is that Williamson’s financial year doesn’t align with the calendar year. The company’s financial year begins on 1st April and ends on 31 March.

As you can see, the tea company has had more profit years than loss years over the past decade.

Is Williamson Tea share price growing?

For you to enjoy capital gains with Williamson Tea shares, you depend on the share price going up. Williamson shares gained 30% in 2023 to close the year at Ksh208, making it one of the top 5 NSE Companies that made investors proud in 2023.

Although shares generally rise in the long-term, it is normal for them to be up sometimes and down other times. Williamson Tea shares have been up and down as well as you can see in the chart below.

While the shares are now trading around Ksh234, they have swung between a low of Ksh150 and a high of Ksh275 over the past one year.

Does Williamson Tea pay dividends?

Williamson Tea is one of the best companies to invest in Kenya for dividends. The company has been paying dividends consistently for many years. In 2023, the company paid an annual dividend of Ksh30 per share, which increased from a dividend of Ksh20 per share the previous year.

What’s striking about Williamson is that it has paid dividends even in years that it didn’t make a profit. For example, the company paid a dividend of Ksh10 per share in 2021 despite making a loss of Ksh146 million that year. It also paid a dividend of Ksh20 per share in 2019 despite making a loss of Ksh172 million that year.

>> A Guide to Investing in Shares at the Nairobi Securities Exchange

Although the dividend amount can fluctuate, Williamson Tea has maintained its culture of paying dividends even in loss years. This shows the company knows how to manage its money well to keep rewarding investors even in tough years.

What is the market outlook for Williamson Tea?

If you seek to invest for the long-term, you would want to invest in durable companies. These are companies that you can expect to remain in business and continue to make profit and pay dividends for many years to come.

Williamson Tea seems to have a bright future. Tea is a favourite drink for many households around the world. Apart from its nutritional value, tea also has several health benefits. For example, studies have shown that tea can help prevent certain types of cancers and neurological diseases, boost immunity, lower cholesterol and aid weight loss.

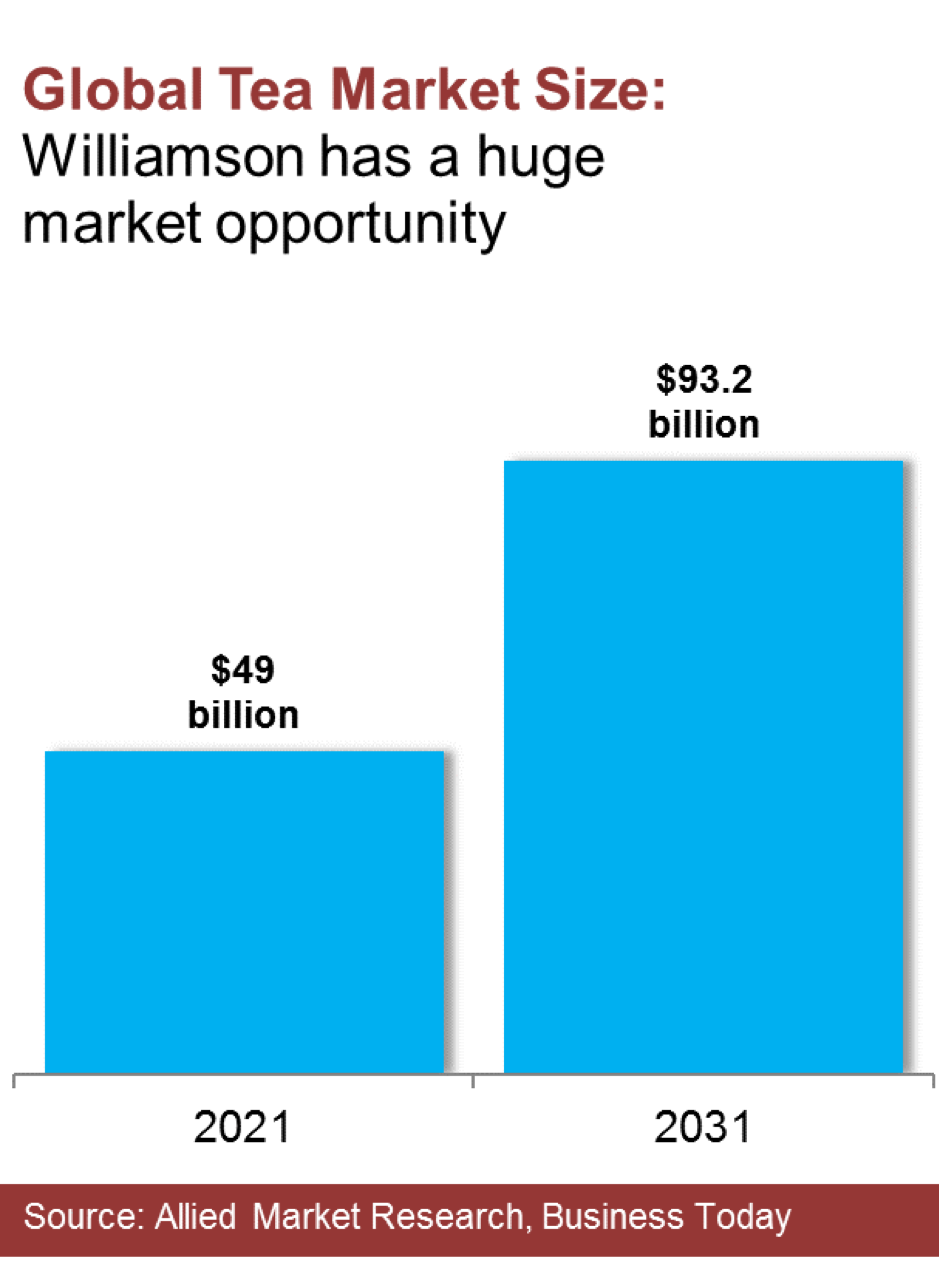

As a result of this, demand for tea is growing. The global tea market is on track to surpass $93 billion by 2031, from $49 billion in 2021.

As you can see, the market is not a problem for Williamson. The company can continue making money as long as it continues to produce tea that the market wants.

How to buy Williamson Tea shares

Williamson Tea shares trade on the Nairobi Securities Exchange under the “WTK” ticker symbol. If you are convinced that Williamson Tea is a good company to invest in, you may want to know how to buy Williamson Tea shares.

The first thing you need to do is find a stockbroker and open a CDS account. Broker fees and features can vary across the board, so make sure you choose the right stockbroker.

It is advisable to select a stockbroker with low fees and online trading support. That would enable you to keep your investing expenses low and allow you to buy and sell shares online at any time.

Once you open the CDS account, the next step is to fund it. That means depositing money to buy the shares you want. Most stockbrokers accept bank and M-Pesa deposits.

How much you should deposit depends on the number of Williamson Tea shares you want to purchase. Bear in mind that the minimum number of shares you can buy per transaction is 100 shares.

>> Eight Most Affordable Shares You Can Buy on the NSE

Leave a comment