Equity Group Holdings (EGH) on Tuesday reported a 24% reduction in its profits to post Ksh9 billion for the half-year ended June 30, 2020, which is Ksh2.9 billion lower than the Ksh12 billion posted at the same juncture in 2019, the group’s unaudited results show.

The decline in profits can be attributed to a high amount of bad loans brought about by the effects of the COVID-19 pandemic. The lender’s total bad loans stood at Ksh39.8 billion at the close of June 2020 up from the Ksh25.7 billion posted the year before.

Equity expects that more customers will continue to default on their loans as espoused by the accounting for a loan loss provision of Ksh8 billion up from Ksh918.5 million in June 2019.

The group’s balance sheet increased from Ksh746.5 billion in H1 2020 from Ksh638.7 billion in H1 2019 as customer deposits increased to Ksh543.9 billion from Ksh458.6 billion during the period under review.

EGH’s interest income earned from loans and advances, investment in government paper as well as deposits and placements with banking institutions stood at Ksh32.8 billion at the end of June 2020 compared to the Ksh27.7 billion raked in at a similar period last year.

On the other hand, non-interest income earned from forex trading and fees and commissions income on loans & advances. Fees and commissions to customers increased to Ksh 2.2 billion in H1 2020 from Ksh1.9 billion in H1 2019.

A cautious approach in the wake of the COVID-19 pandemic is also reflected in the net loans and advances to customers which shrinked significantly from Ksh391.6 billion from Ksh320.9 billion.

Shareholders’ funds defined as the amount of equity in a company that belongs to the shareholders rose from Ksh102.7 billion in H1 2019 to Ksh123.4 billion at the end of June 2020.

Earnings Per Share fell to Ksh2.39 in H1 2020 from Ksh3.18 in H1 2019.

Restructured Loans

By June 5, Equity Bank had restructured Ksh92 billion worth of loans, equivalent to about 25 per cent of its net loans at the end of last year to cushion its customers from the effects of COVID-19.

The restructuring is being done on a case by case basis. The restructuring includes extending of the tenor agreed between a borrower and the bank.

Kenyan banks are restructuring loans taken by borrowers following intervention from the Central Bank of Kenya (CBK) which made policy changes after Kenya was struck by COVID-19 with the view of protecting Kenyans and the larger economy.

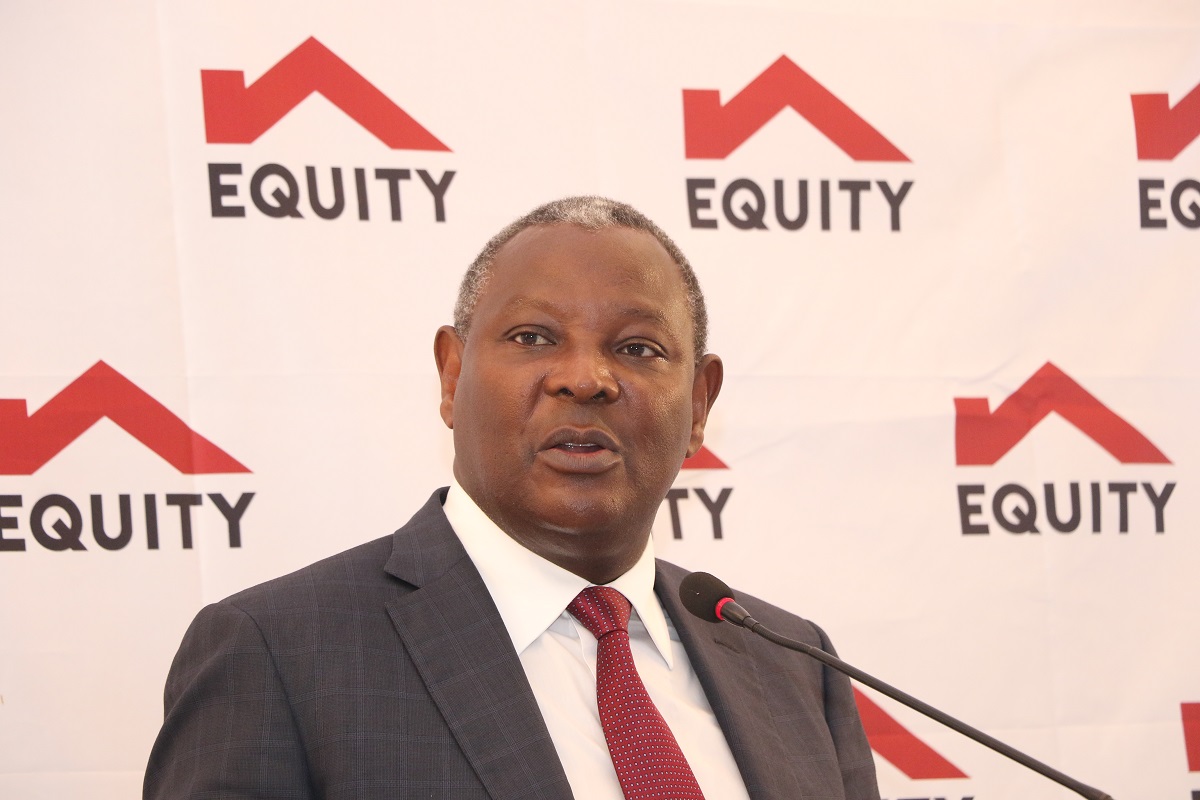

“Clients who can demonstrate the impact of COVID-19 on their businesses and the soundness of their business model in the new normal will get reprieve in terms of loan rescheduling and refinancing with up to an additional three years of repayment,” said Equity Bank CEO James Mwangi in June.

Leave a comment