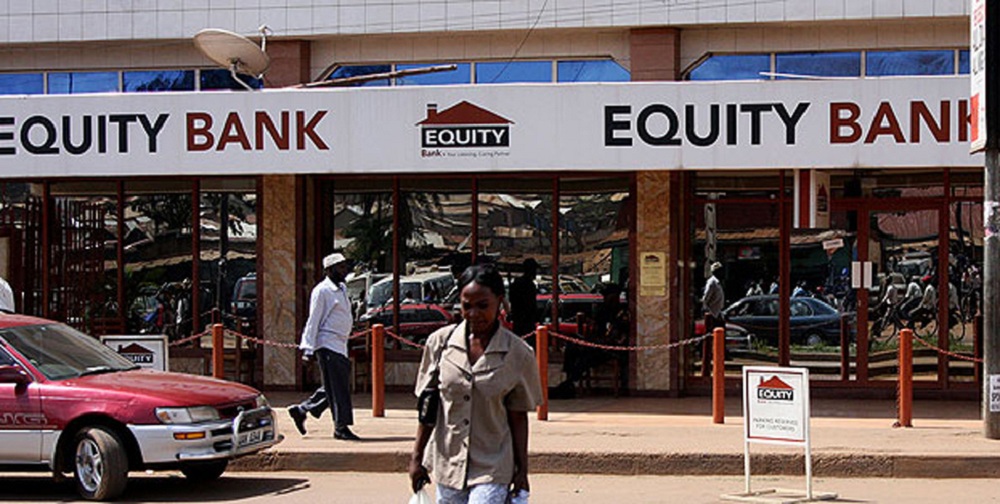

Equity Bank, GT Bank, and Capitec are the preferred retail banks among citizens of Kenya, Nigeria, and South Africa, respectively, a new straw poll survey conducted by leading mobile research firm GeoPoll on the state of retail banking in three of Africa’s biggest economies indicates.

This, even as research shows 80% of the adult population in Africa do not use formal or semi-formal financial services.

While financial penetration remains low in Africa overall, 95% of survey respondents in Nigeria, 94 percent in South Africa, and 90 percent in Kenya indicated that they maintain at least one active bank account, according to the results of the survey.

Among those with active bank accounts in the three African countries, customer service was named the most important factor when deciding which bank to use by a majority of the survey respondents.

The study used GeoPoll’s proprietary mobile data collection technology, the GeoPoll mobile app to reach users in Nigeria, Kenya, and South Africa. The respondents were served more than a dozen questions about their personal retail banking habits and preferences.

Among its key findings is that Equity Bank is the most popular retail bank in Kenya, with 40% of survey respondents indicating they held a primary account there.

Related: Strong credit profile earns Equity Bank Moody’s first time global ratings

In Nigeria, 31% of respondents said they used GT Bank for their primary account, making it the most popular in that country while in South Africa, the most popular retail bank is Capitec, with 39% of respondents indicating it as their primary bank

According to the study, just 14% of bank customers in Nigeria hold three or more bank accounts. In South Africa and Kenya, just 6% and 5% of customers held three or more bank accounts, respectively.

Transaction fees, a lack of adequate loan facilities and complicated loan processes were among the likeliest reasons citizens of Nigeria, Kenya, and South Africa are unhappy with their banks.

GeoPoll’s survey was conducted among 2,825 unique respondents aged 18 and above, including 1,565 in Kenya, 1,002 in Nigeria, and 258 in South Africa.

Leave a comment