Equity Bank has raised a total of Ksh 10.3 billion (US$100 million) from a consortium of European development finance institutions to enable the lender’s continued growth and strengthen its capitalisation.

The latest is Ksh1.6 billion (US$15 million) provided by Swedfund, the Swedish Government’s development financier, in the form of a long-term subordinated loan.

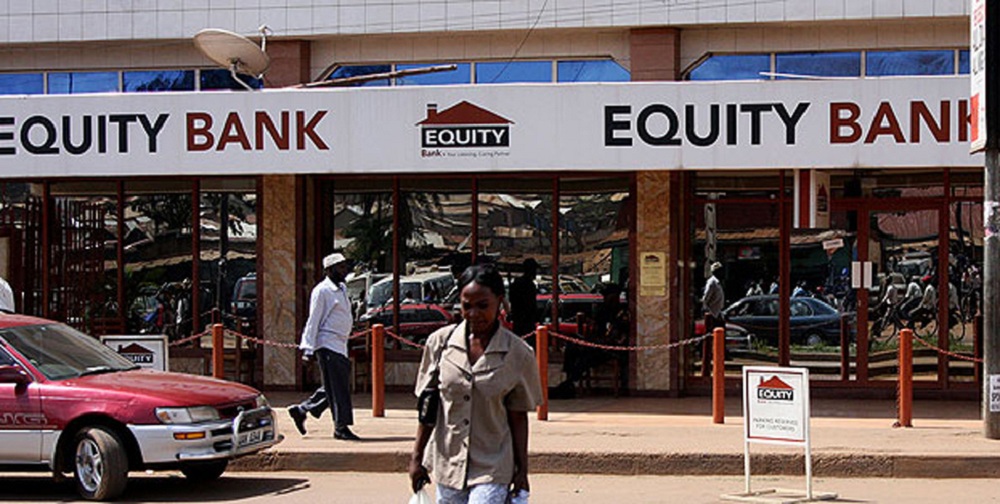

Equity Bank is working towards enhancement of access, convenience and affordability of financial services by providing financial services to Small and Medium Enterprises (SMEs), the low-income segment and the un-banked population.

“As a Development finance institution, we have an important role to play. By investing in financial institutions and funds we help them to boost funding and lending to local businesses and entrepreneurs. We enhance our partners the consideration of environmental and social risks and impacts of lending by agreeing on a plan of action,” said Maria Håkansson, CEO at Swedfund.

She added, “We are pleased to support a bank that focuses on SMEs, as this segment account for 4 out of 5 new job opportunities and contribute up to 33% of GDP.”

Equity Bank CEO Dr James Mwangi has previously averred that the problem facing SMEs is the cost of finance. This is determined by market forces that are guided by the government’s rate of borrowing through treasury bills and bonds but also driven by inflation.

He emphasised that although only 24% of loans in Kenya go to SMEs, targeted intervention by Equity Bank has seen the advances to SMEs rise to 72% of the bank’s loans portfolio.

“72% of Equity Bank’s lending is dedicated to SMEs. We have segmented SMEs into different categories in order to serve them better,” Dr Mwangi at the launch of a research report by IAA in collaboration with the Strathmore Business School.

In his review of the IIA Report Dr Mwangi said 7 out of 10 startup SMEs fail because they are driven by passion rather than reason.

“Banks are not driven by passion but by research and guided view of what will work. Unlike the SMEs that borrow from relatives with no intention to repay, banks have a responsibility to protect depositors’ money,” said Dr Mwangi.

He demonstrated how training 1.4 million entrepreneurs on financial literacy resulted in significant growth of SMEs.

“We have realised for those advanced the loans, their savings increased three-fold and their non-performing loans declined.”

University of Nairobi don, Dr Bitange Ndemo said paralysis of analysis sets in when people become very educated and start seeing problems in the wrong places.

He encouraged SMEs to aggregate their products to enjoy economies of scale like big businesses.

Lauding Equity Bank for supporting SMEs, Dr Ndemo said: “a case study should be done on Equity Bank to understand how it is lending money through mobile platforms and supporting the SME sector through tailored services and products.”

Leave a comment