Kenyans have become a busy lot these days. With the rising cost of living and the quest to earn that extra shilling, full time business and side-hustles have become a way of life, attracted by the digital space that has reduced the cost of promoting products and collapsed national boundaries.

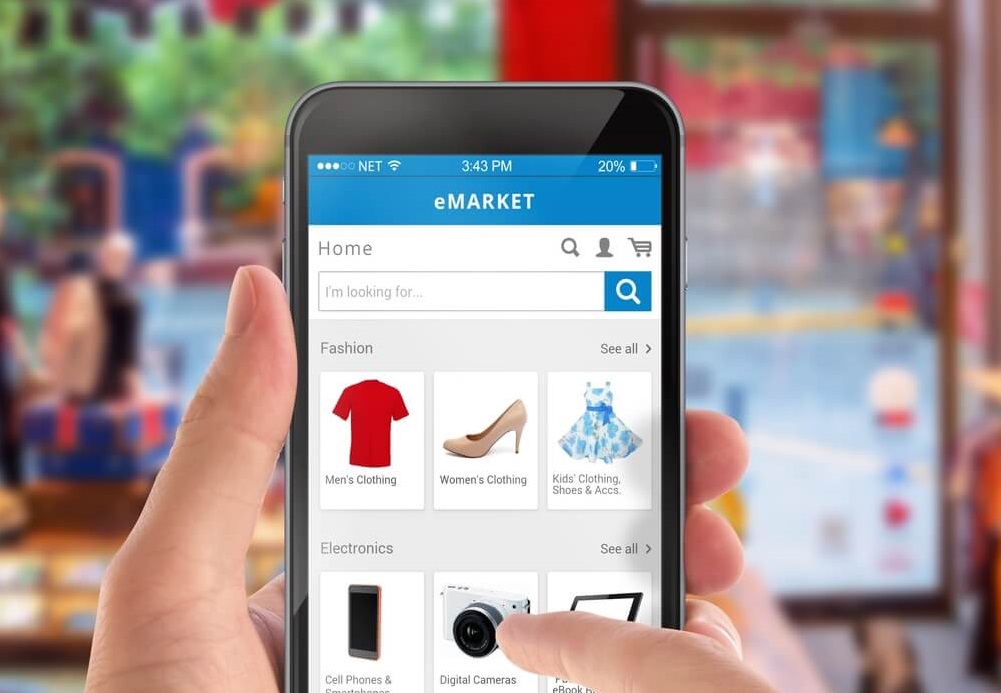

Social media platforms such as Facebook, Twitter, Instagram and Whatsapp are buzzing on smartphones – a sign that either someone has promoted a new product or a prospective customer is making an inquiry. More astute businesses have created websites to market themselves and interact with customers.

While business deals are closed through digital platforms, one thing remains a challenge: payment. The commonly used payment options including cash and mobile money transfer pose constant security and fraud risks. For clients outside Kenya, available money transfer services are either expensive or not first enough.

To give business people a peace of mind, Cooperative Bank has launched an e-Commerce solution that takes away the payment troubles both in the digital marketplace and offline. By using the Co-opBank eCommerce solution business people will get more customers by expanding payment options through online card payments.

The solution is such that even merchants without a website can still receive payments through Co-opBank eCommerce. The solution is free and needs no integration.

Merchants without websites

Using Co-opBank eCommerce solution is easy without a website. The merchant receives a unique link (Pay-By-Link) for invoicing customers.

- Once the merchant and the customer agree on the pricing, the merchant sends the payment link to the customer’s email address.

- The customer will receive an invoice with the link on their email.

- The link will open up a portal where the customer inserts his/her card details and the amount they are to pay.

- Once the payment goes through, merchant receives a payment confirmation via email and SMS.

- The customer will also receive a notification via SMS in if they have subscribed to SMS alert with their card provider.

Advantages of Co-opBank eCommerce Solution (Pay-By- Link) Option include:

- The merchant does not incur any cost to get the Pay-By-Link solution.

- The solution is secure, because it is 3D secure, with two-factor authentication for all card payments

- In the event a customer makes a wrong payment, the merchant can reverse the payment without calling the bank for a reversal

- The customer cannot reverse a payment, which reduces the risks of merchants losing money to dubious dealers.

- Payment reconciliation is easy for the merchant since they can track payment and view payment from a single dashboard.

Merchants With Websites or Mobile Apps

Merchants who have built web checkout & mobile applications (APPs) and would like to enrich their applications with online card payment acceptance can now do so with Co-opBank eCommerce Solution.

Simplicity: The integrations models are easy and quick to implement.

Reliability: Once integrated to a merchant site, the solution is available 24/7.

Safety: Co-opBank eCommerce platform is payment card industry-data security standard (PCI-DSS) compliant ensuring safety and security of customer card details.

- Best customer experience and practice: Dedicated relationship management backed by 24/7 operations support.

- Convenience: Most of all, it creates convenience to customers overcome geographical limitations.

For inquiries, send email to: [email protected] or call 0711 049 406 (8am – 5pm) | 0703 027 000 (24/7) or visit Co-op Bank eCommerce website.

Also Read…

>> Co-operative Bank Extend Joint Venture With South Sudan

>> KTDA Chief Executive Quits As Probe Tightens

>> Broke KU’s Bank Accounts Frozen By KRA

Leave a comment