The Capital Markets Authority (CMA) on Friday announced the admission of two firms namely; Pyypl Group Limited and Belrium Kenya Limited, to its Regulatory Sandbox test environment.

The two firms will test innovations in accordance with the requirements of the Capital Markets Regulatory Sandbox Policy Guidance Notes (PGN).

Pyypl Group Limited (pronounced as ‘people’) seeks to test its Pyypl for Entrepreneurs product, a blockchain-based platform for issuance of debentures (unsecured bonds) among entrepreneurs for 12 months.

The firm is licensed by the securities market regulator in United Arab Emirates – Financial Services Regulatory Authority in line with the Regulatory Sandbox PGN. Its subsidiaries in Bahrain and Kazakhstan are also active and licensed by the Central Bank of Bahrain and Astana Financial Services Regulatory Authority (Kazakhstan) respectively.

Belrium Kenya Limited has been admitted to the Regulatory Sandbox to test a blockchain-based and shareable know your customer (e-kyc) solution for capital markets intermediaries and investors.

The test will be executed in a period of nine months. It’s parent company Belfrics Malaysia Sdn Bhd is a reporting institution with Bank Negara Malaysia.

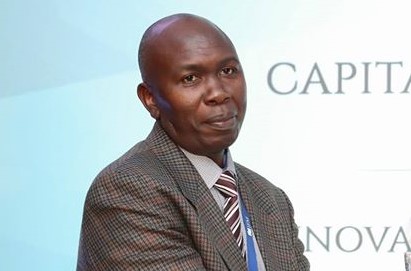

CMA Acting Chief Executive Mr. Wyckliffe Shamiah said, ‘we are encouraged to note the appetite for the Regulatory Sandbox among fintech firms and innovators within and beyond Kenya’s borders. This underscores the need for stronger coordination with financial sector regulators and other government agencies to ensure that there are no gaps or overlaps,”

“Additionally, such coordination will ensure that scalable solutions touching on multiple sectors can be put in place where necessary.’ The developments cement the Authority’s efforts to leverage technology to drive efficiency in the capital markets value chain,” added Shamiah.

Mr Shamiah further noted that CMA has relied on cross-border cooperation with peer regulators for fit and proper assessment of the two entities whose parent companies and their directors are incorporated in other jurisdictions, as part of the application review process.

CMA said it will closely monitor the two firms during the testing period, relying on feedback from investors, system logs and periodic reports.

Since the Regulatory Sandbox became operational in March 2019, six companies have been admitted to test their innovations and one company has successfully exited the Regulatory Sandbox and is preparing to roll out the innovation to the wider market.

Leave a comment