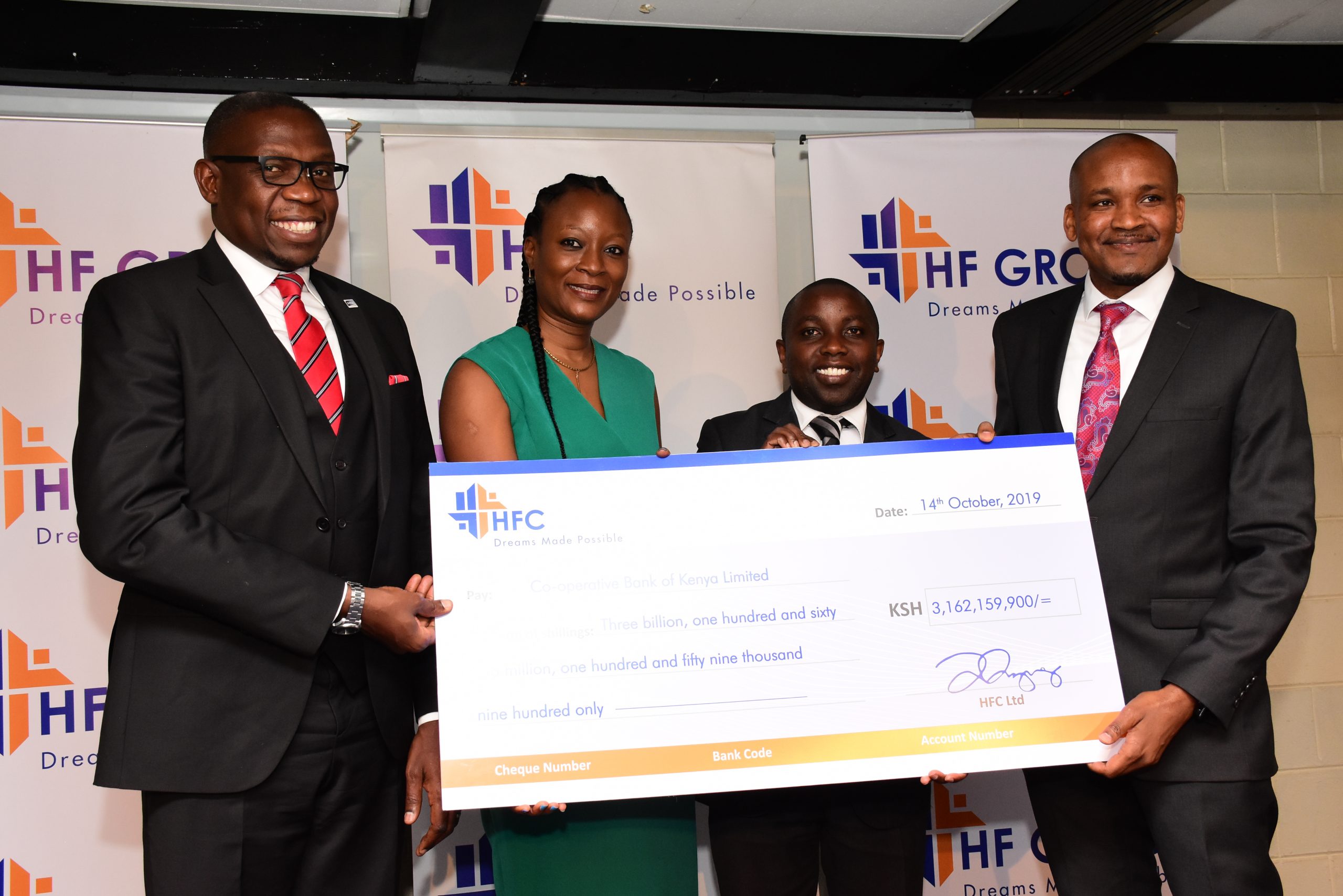

Housing Finance Group PLC (HF Group) on Monday announced the redemption of its Ksh 3 billion corporate bond which matured on October 14, 2019. The Medium Term Note was issued in 2012 with a 7-year tenor at a coupon of 13%.

Speaking at a Nairobi hotel, HF Group Chief Executive Officer (CEO) Robert Kibaara said that the company is satisfied with he returns it generated for its investors so far. He added saying that the company has maintained its understanding of the market to sustain its consistent operational metrics while meeting its responsibility to investors.

The company had recorded a significant Ksh.97 million loss for the first six months of operations in 2019.

The losses forced the bank to reduce non-performing loans by Sh 2 billion as mortgage holders struggled to repay their loans. At the same time, the company also revealed that it had enrolled 700,000 customers on its HF Whizz App that transacted deals worth Sh 3.7 billion.

The bond significantly aided HF Group to bolster its loans and advances, which grew from KSh. 25billion to KSh. 44billion as at December 2018 while total assets grew from KSh. 31 billion to KSh. 57billion within the same period.

‘’The funds raised played a pivotal role in the growth of our full-service banking offering and specifically in financing the working capital and expansion of the bank’s growing SME customer base, end buyer mortgage financing and asset financing,’’ noted Kibaara.

The retired bond also propelled the Group’s project financing of developers seeking to tap into the growing housing demand, the sales of which was accelerated after the launch of the Shika Nyumba Na HF campaign, which the Group CEO noted has helped create widespread awareness of the listed lender’s projects and those it has financed.

‘’We have sold more houses in the last eight months than the previous two years combined, which boosted our liquidity and hence fully financing the bond repayment. Our mission is to improve the quality of life for individuals and communities both now and in the future, by providing better homes, amenities, retail and leisure spaces matched with security all within the sphere of affordable housing agenda,’’ the Group CEO added.

The Group continues to make strides on its business turnaround strategy that includes diversification to full-service banking while leveraging digital transformation to enhance operational efficiency, customer experience, and accessibility.

Leave a comment