The mobile phone has afforded us the convenience of transacting anywhere without the limitations of not having cash or a bank account.

However, the convenience it brings could be one way that your expenses could be getting out of hand.

Did you know that the money you spend on charges per transaction could be a big deal if it was saved over time?

These charges have increased even more as the government is taxing you to spend your money in a move to increase tax collections.

How to save money in hard economic times

Those with clean money in our society are few. The fabulously rich however are the envy of many trying to make their way up the success ladder.

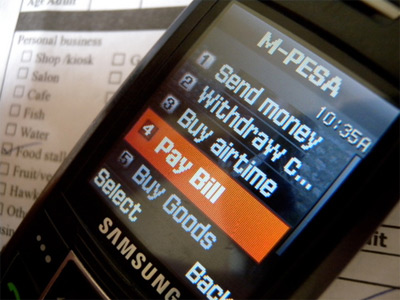

In Kenya, mobile money has revolutionised how we pay for goods and services.

While it comes at great payments convenience, evaluating and cutting down on convenience costs is one of the ways you can save some money.

Penny-pinching is painful but no one ever made money by spending it.

To make your money grow, you would have to adopt a new saving culture. If you’ve never sat down to evaluate your spending habits, then the time to begin is now. It is never too late to start saving for that rainy day.

Saving does not mean that you have to be earning a lot to start. It all starts with being accountable for every single cent that passes through your hands.

The reality is that while it may take a lifetime, you can and build a whole future from saving a little regularly.

With the mobile phone and its payment conveniences, one of the ways you can save is by evaluating and cutting down on costs that come with it.

Embracing paying in cash will ensure that you cut out your service provider who is the middleman making your life costlier.

How mobile money transactions can get you into debt

Mobile banking and money transfer have made paying bills, booking flights, paying for tickets and shopping among many others so convenient that it has replaced the once bulky wallet.

As this makes transactions safer from not having to carry cash around, the costs that come with it can oftentimes go unnoticed with costly consequences which could drive you into debt.

The latest entrant into the market to make sure you have easy access to loans is Safaricom’s Fuliza.

Kenya’s biggest telco says that Fuliza enables you to complete your M-Pesa transactions even when you have insufficient funds in your M-Pesa account.

This does not come free and Safaricom’s overdraft facility in partnership with the Uhuru Kenyatta family-owned CBA means that you get in debt if you are unable to repay your loan in time.

So the best deal is to avoid these loans at all costs for your benefit and ability to grow your own money.

With the convenience of mobile money banking, loans become easier to get but the user ends up paying more for this convenience.

How to make your money grow

The biggest one is learning to say no.

Saying no to mobile money loans unless you really need them and reducing the usage of mobile money transactions is a good place to start.

Making this change will be painful but worth it in the long run.

Like I’ve mentioned before, no one ever made money by spending it. Thus, making your transaction charges per month become your little step to building your savings will go a long way.

Ditch the mobile phone money convenience and see how true haba na haba hujaza kibaba is.

Happy saving!

Penny wise advise.

This is very very true

Your analysis is right but in your next article evaluate the cost of convenience

Thank you for this.

We shall be doing something on that in the future.

The suggestion is OK and also people have to know that it takes time to make money.so there is no need to spend it in a very short period of time.lets ditch mobile money