The Kenyan insurance industry’s profit before tax plunged 18% in the financial year ended December 2017 attributable to the prolonged electioneering period and drought.

According to a report released on August 30, 2018 by the Association of Kenya Insurers (AKI), the industry’s profit before tax was Ksh12 billion in 2017 compared to Ksh14.75 billion in 2016.

It was not all gloom as the industry recorded a 6.5% growth in 2017 as compared to the 13.4% recorded in the previous year.

Kenyans also took different covers in 2017 as Insurance premium grew slightly to Ksh209 billion from Ksh197 billion in 2016.

This is manifested by the fact that net claims paid out to policy holders stood at Ksh99.13 billion as compared to Ksh85.41 billion in 2016.

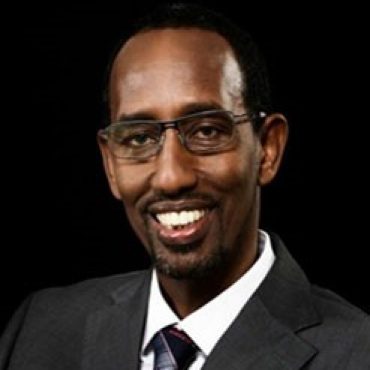

“Assets also grew by 12.21% to Ksh571billion. The overall insurance penetration was 2.71% in 2017 compared to 2.75% in 2016,” said AKI Chairman Hassan Bashir while releasing the results.

READ: HF GROUP HALF-YEAR PROFIT PLUNGES TO KSH 12.6 MILLION

The industry is also bracing itself for legal and regulatory changes following the reading of the Budget Statement in June.

The changes include include the proposed amendments to the Insurance Act, the intended review of the Income Tax Act as well as compliance with the Risk Based Capital requirements by June 2020.

The industry is also expected to comply with the International Financial Reporting Standards (IFRS17), which has synchronised accounting and risk based supervision regimes.

SEE ALSO: HENNESSY TAPS AFRICA’S CREATIIVE SPIRITS IN NEW CAMPAIGN

Compliance with IFRS17 will require a shift in organizational culture and strategy to focus more on operational efficiency.

All types of insurance recorded positive growth but for Personal Accident (-9.08%), Motor Commercial (-3.33%) and Medical insurance (-0.71%).

3 Comments