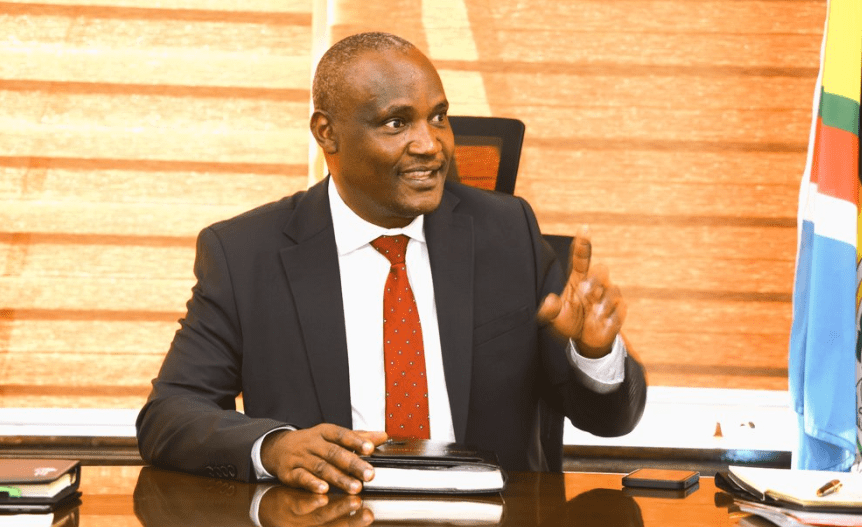

National Treasury Cabinet Secretary John Mbadi has promised to protect Kenyans from over-taxation, even as the dates draw nearer for the Finance Bill 2025 to be unveiled.

Mbadi, flanked by Kenya Revenue Authority (KRA) chairman Ndiritu Muriithi, Mbadi promised that the tax bill for this year may not have upward tax amendments.

“We cannot overtax Kenyans anymore. We have reached a limit where we are saying no more space for taxation, especially on employment income, under my watch. We are not increasing VAT at all actually, the finance bill this year may not have any tax adjustment upward in terms of rates,” said Mbadi.

The Finance Bill 2025 is expected to to be presented before Cabinet on April 18, 2025, before being tabled in the National Assembly.

Mbadi says thathe also wishes to do away with taxes on retirement benefits to ensure that retirees take home thair whole amount.

“When I get my pension, I take the whole of it without surrendering anything to the government,” he reiterated.

Improved payslips

According to Mbadi, the government, even before the finance bill is floated, has improved Kenyans’ payslips.

“We have improved people’s payslips; it is only that sometimes we overplay this discussion around payslips getting thinner,” Mbadi said.

This follows tax amendment laws implemented in 2024, aimed at easing the tax burden on Kenyans, especially those on employment.

“It is now a relief, housing levy is a relief, SHA is now a relief, it is not double taxed. There is this thing of saying that we are overtaxing. I have looked at the taxes because I was trying to see how I can make the payslips better,” the CS said.

Mbadi said the introduction of the Housing Levy and the Social Health Insurance Fund has been misrepresented as excessive taxation.

“Let me just take a payslip of someone who is earning Ksh100,000 and take SHIF that takes from this person 2.75 per cent that if you calculate from his salary is Ksh2,750 that is what used to be deducted before,” Mbadi said.

“With the tax laws we brought in, in December (2024), the effective amount we are taking from you is not Ksh2,750, but it is about Ksh1,925. Before in NHIF, you were contributing Ksh1,700, remove that amount, and you will realise the extra amount that the government is taking from you for SHA is Ksh225.”

“Those who are hurt by the taxes are those that Kenyans may call earn super-salary, but when you start adding it, you don’t see it as super. But the middle class, not so much.”

Read: Why Moody’s Revised Kenya’s Outlook From Negative to Positive: CS Mbadi

>>> A New Ruto Emerges From Finance Bill and Adan Deals

Leave a comment