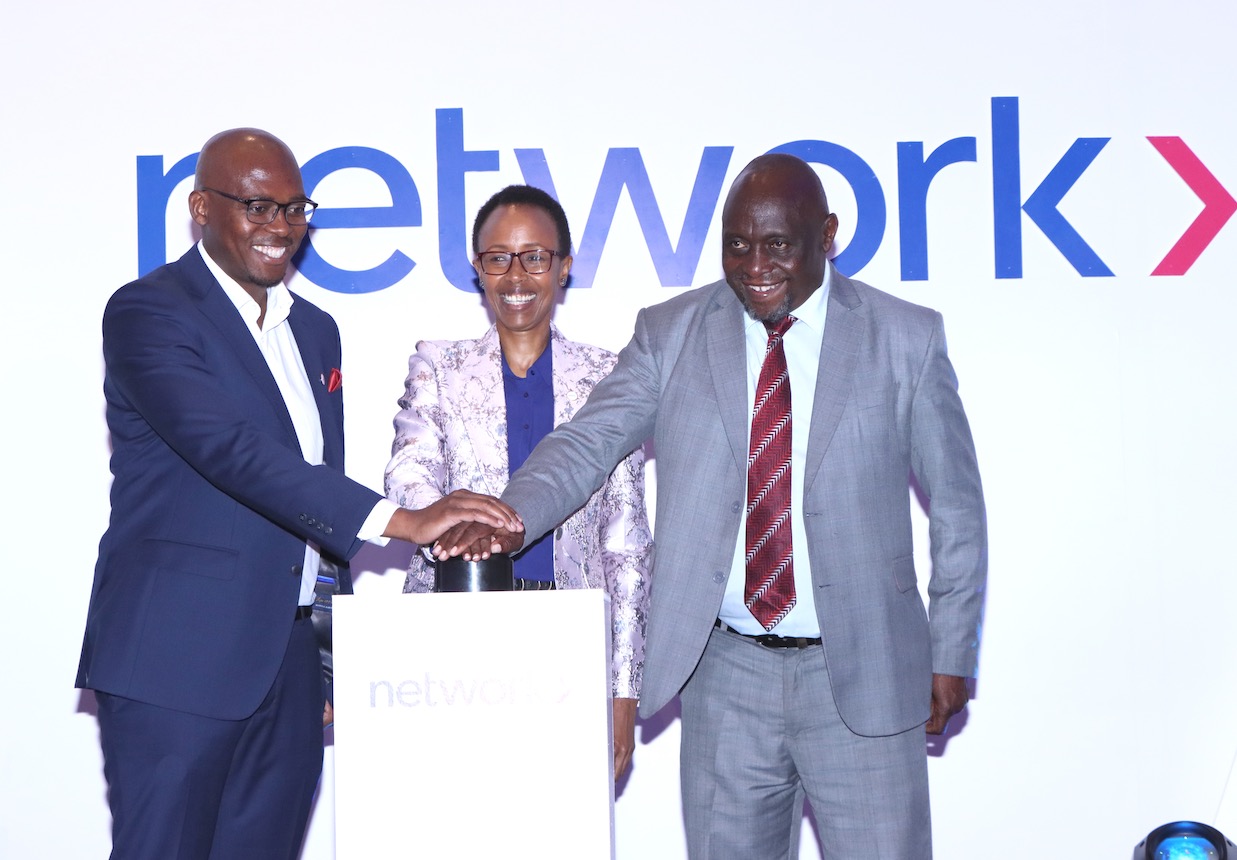

Network International (Network), a leading enabler of digital commerce across the Middle East and Africa (MEA) region, has launched innovative in-person payment solutions in Kenya, as part of its plans to transform payment across Africa.

“Launching our point-of-sale solutions is part of our strategy to enter the in-person payments market in Kenya. As a company, we are currently known as a pioneer in the online payment space in Kenya and across Africa. We are introducing what we are known for globally into the African continent with Kenya as a key hub for East Africa,’’ noted Ms Judy Waruiru, Network’s Regional Managing Director, Acquiring, East Africa.

Network International has identified a growth opportunity in Kenya’s in-store payment solutions market. According to the Central Bank of Kenya, there are slightly over 55,000 POS machines in Kenya. This number is significantly low compared to the number of registered businesses in the country ,which stands at 7.4 million Micro, Small, and Medium-sized Enterprises, according to the Kenya National Bureau of Statistics.

Network is set to offer a cost-effective solution with QR code payments and boost card payment adoption across Kenya by making POS systems more accessible to merchants. This will ensure that no customer is excluded from making payments, leading to more business opportunities and increased revenue for merchants.

> Standard Group New CEO Lands New Role at Absa Bank

“We are now ready to roll out our next stage for growth in the continent. Africa is a largely underserved market by point-of-sale solutions. Our agenda is to offer a cost-effective solution with QR code and portable Point of Sale payments, enabling card payment acceptance even at the micro-level, opening up new possibilities for small and growing businesses. We have managed to do this successfully in the Middle East and Africa, and we believe we will make it work in Kenya,’’ Judy added.

This focus is in line with the National Payments Strategy 2022 which was launched by the Central Bank of Kenya. In remarks read on behalf of CPA John Mbadi Ng’ongo, EGH, Cabinet Secretary for the National Treasury and Economic Planning, the Deputy Director, Financial and Sectoral Affairs at The National Treasury, Mr Ronald Inyangala, noted that the adoption of QR Code Payments and Interoperability are in line with the Government’s Digital Plan.

“Aside from mobile-based payments, new technologies allow Point of Sale (POS) software systems to play a larger role in invoicing, receipt generation and transaction management,” he noted.

The newly launched POS solutions will be provided free of charge to merchants, enabling businesses of all sizes to accept payments on the go. They allow customers to pay using their mobile wallets or card, catering to diverse payment preferences. Small and medium-sized enterprises (SMEs) can now track and reconcile all their mobile money and card payment transactions from a single point of reference.

> Nabo Money Market Fund Interest Rates and Joining Steps

The POS device is engineered for longer battery life compared to traditional POS machines, ensuring uninterrupted service for merchants. As part of Network’s comprehensive suite of payment products and services, the POS system integrates smoothly with existing financial ecosystems.

Mpho Sadiki, Network’s Group Managing Director for Merchant Services, Africa said it is possible to scale the POS and QR code payment solutions across all merchants and traders in Kenya. “There is no reason a trader selling goods at the Maasai market should not be able to accept card or mobile money payments on a single device,” said Mr Sadiki. “Simple and convenient digital payments solutions have scaled successfully in other markets across Africa and we see it scaling successfully in Kenya.’’

Leave a comment