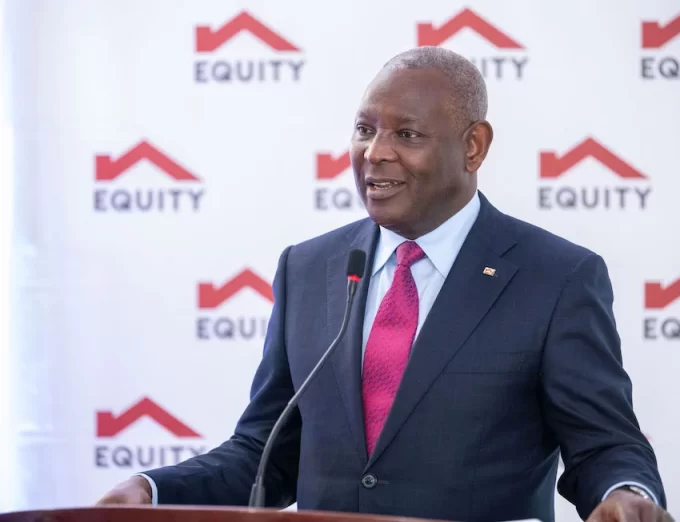

Equity Bank CEO James Mwangi on Friday, March 11 offered insights into how exactly he runs Kenya’s biggest bank.

He spoke during a morning interview on Capital FM where he discussed, among other things, his love for country music, his 31 years at Equity and the firm’s prospects and its Wings to Fly scholarship program.

“I joined Equity when it was a building society in 1991 with a vision to bring financial inclusion in Kenya,” he noted.

The bank crossed $10 Billion (Ksh1 Trillion) in assets in 2020. It operates in six African countries including its new jewel, DRC, and aims to have 100 million customers by 2025 – up from the current 16.4 million.

It was ranked among the world’s 1000 biggest banks in 2021 by The Banker magazine. It placed 22nd in Africa and 761st globally based on its Tier 1 capital base.

READ>> Kenya Now With The Cheapest Diesel In East Africa

Mwangi has steered the company for much of its rise. Questioned on how he he continues to do it, he offered insights into his approach to management – centered on building a strong team.

“Delegation and empowerment is my management style,” he stated.

Mwangi further observed that 60% of Kenyan bank account holders banked with them. He urged Kenyans to place greater value in local goods and services.

Mwangi also spoke on the 2022 General Elections this August, urging Kenyans to register to vote in large numbers.

“Failure to vote is failure to have a leader that we believe will give us a better future,” Dr. Mwangi noted.

![Equity Group Chief Executive Officer (CEO) James Mwangi. He has served Equity for 31 years, 15 as CEO. [Picture by Francis Nderitu/ NMG]](https://businesstoday.co.ke/wp-content/uploads/2022/03/james-mwangi.jpg)

🥰

Whereas Equity is a very strong Bank assetwise, its biggest weakness lies in what Mwangi has just mentioned. Delegation and empowerment which is essentially based on people. Walk into any Equity Branch and you will find a number of clueless staff members either on internship and who are learning on the job itself. The staff cannot complete a task without referring to other staff. Any bank should never let their staff experiment what don’t know with customers. Customers come in for quick services but not as opportunities for staff to experiment what they have been trained on.

Besides this weakness in Equity, the next biggest weakness is their systems. Their systems are either slow or are down. In 1 or 2 days in a week, their systems might are always down. This is so perennial such that there seems to be no solution in sight. It seems as Equity has internalized and accepted it as a norm! Given that this aspect of delivery will continue to be critical, the bank will have to do something to make the systems very efficient or it has to contend with loss of customers who consider this as very critical.

In a nutshell, Equity’s twin problems are its demoralized staff and perennial systems downtime!

Transition from school work to work life is not easy , therefore these young staff need time to blend with the senior staff

I am a member and have been one for more than a decade

Great and influentual business leader in Kenya. I see Mr James Mwangi as a mentor to a lot of aspiring entrepreneurs in Kenya.

I’m on Instagram as @j9_njoroge. Install the app to follow my photos and videos. https://www.instagram.com/invites/contact/?i=p7ji1i80k8wh&utm_content=4z6e9ho

Partnering with Goldstein Hockey Foundation to sponsor hockey, chess or soccer.

The issue that does not go well at equity bank is the way they give loans. They are very discriminative in that area. One time I tried to borrow a loan using my investigation firm in order to buy investigation gadgets but they declined. The account at the time was vibrate. The account now is lying domate. I was very abset.