The government has announced several amendments to the existing tax laws to enhance compliance, expand the tax base, increase the tax revenue and consequently reduce reliance on borrowing.

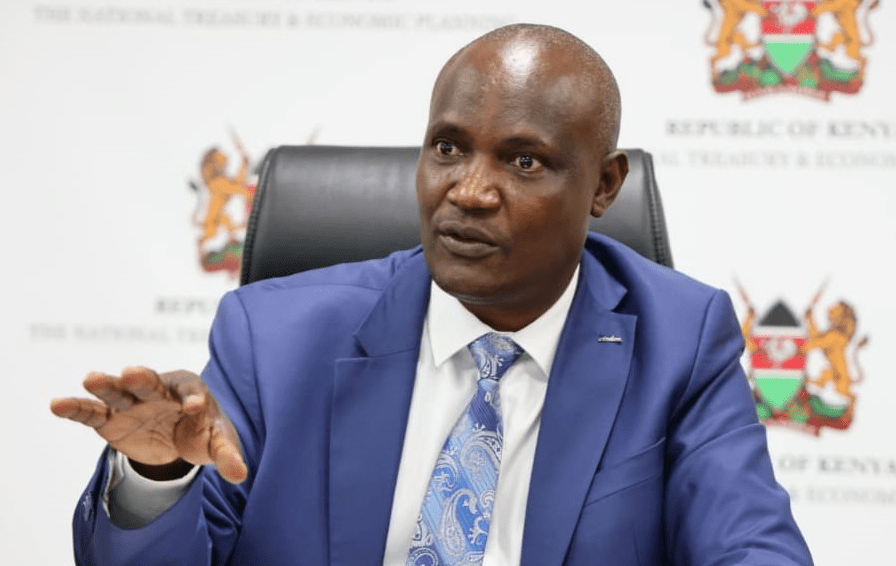

The amendments, according to Treasury Cabinet Secretary John Mbadi, are hinged to the new tax policy which greatly advocates for fairness and equity.

“For the first time we have a tax policy that highly advocates for fairness and equity in tax collection. If we expand the tax base it will ease the tax burden for most Kenyans. Traditionally, employed Kenyans have carried a bigger percentage of the tax burden. We want to ensure fairnes in the proposed tax reforms,” Mbadi said when he met digital publishers in his office last week.

Here are some proposals in the Tax Laws (amendment) Bill 2024;

Among the proposed changes include amendments ection 3 of the Income Tax in the definition of the term digital marketplace by including ride-hailing services, food delivery services, freelance services, professional services etc.

This proposal is to expand the tax base by bringing the income of the owners of the digital platforms that offer the above services into the tax net.

The proposal was triggered by the fact that some digital platform owners have been operating in Kenya and not paying tax, ye t they earn money in the country.

“An example is the digital platform operating Uber services. This proposal is aimed at expanding the tax base and bringing in more income into the tax net. This will not target individuals who operates Uber and the common citizens who use Uber taxi services,” the government explains.

Individual Retirement Fund

The amendments are proposing to restrict the Commissioner’s authority in rendering an independent definition as to what pertains to an individual retirement fund. This move shall bind the Commissioner to the registration of a trust deed with the Retirement Benefits Authority (RBA) and not grant the Commissioner the power to subsequently define the same.

The purpose of the proposed deletion is to create clarity for the retirement funds to abide by the RBA regulations and reduce the need to seek additional confirmation, and adherence from the Commissioner of their dispensation of incomes to the beneficiaries under Section 5 of the Income Tax Act (ITA).

Provident Fund

This will include any fund or scheme for the payment of lump sums and other similar benefits, to employees when they leave employment or to dependents of employees on the death of those employees but does not include any national provident fund or national social security fund established by the Government and registered provident fund means one which has been registered with the Commissioner in such manner as may be prescribed.

This is a relief as one does not have to register the fund with the Commissioner as earlier prescribed.

f) Donation

The Tax Laws (amendment) Bill 2024 proposes to introduce a definition of the term “donation” to mean a benefit in money in any form, promissory note or a benefit in-kind conferred on a person without consideration.

The simplicity of this proposal is outstanding as there exists no explicit definition of the term “donation” in the ITA. This is a welcome move as it sheds light via the articulation of what pertains to a donation. The tax treatment of donations is unique from other incomes as donations are treated differently from business income, interest income and the like.

To further reiterate the need for this definition in the Act, there exists The Income Tax (Charitable Donations) Regulations, 2007 and other unique treatment of such incomes.

Income from employment

Non-Cash Benefit

The current drafting of the Income Tax Act (ITA) allows a limit of Ksh3,000 per month (Ksh36,000 per year) of non-cash benefits to be accorded to employees without consideration of the same in their monthly gross earnings that would be chargeable to tax under Section 5 of the ITA.

The Tax Laws (amendment) Bill 2024 proposes an amendment to the limit to Ksh5,000 per month (Ksh60,000 per year).

The proposed amendment seeks to expand the amount employees can enjoy as non-cash benefits without suffering additional taxation under the employment income tax ambit. This is a welcome move that incentivizes employers to extend additional benefits to their staff, which is a welcome move.

Meals Provided by employers to employees.

It has been proposed to increase the limit deemed as a chargeable employee benefit for meals provided to them by the employer from Ksh4,000 per month (Ksh48,000 per year) to Ksh5,000 per month (Ksh60,000 per year).

The Tax Laws (amendment) Bill 2024 seeks to add measures to cushion employees from the rising cost of living vide the proposals to increase the limits of various cash and non-cash benefits.

Significant Economic Presence Tax

The Bill proposes to introduce a new tax to be known as Significant Economic Presence Tax. This tax shall be payable by a non-resident person whose income from the provision of services is derived from or accrues in Kenya through a business carried out over the digital marketplace.

The proposed amendment is intended to replace the Digital Service Tax with Significant EconomicPresence to provide for taxation at the effective rate of 6% as opposed to 1.5% under the Digital Service Tax.

After meeting the digital publishers last week, Mbadi promised to see if the tax can be adjusted to be in line with other countries, at 3%.

Minimum Top-up Tax

The Bill seeks to introduce a tax to be known as the minimum top-up tax. The Minimum Top-Up Tax will require multinationals to pay a minimum effective tax rate of 15%. This is an additional tax that will be payable in Kenya by a multinational enterprise which has an effective tax rate of less than 15%. The multinational enterprise must have a consolidated annual turnover of Ksh100 billion.

The minimum top up tax is aimed at reducing base erosion and addressing the tax challenges from international business transactions. It aims at ensuring that a minimum tax rate of 15% is paid irrespective of any tax incentives offered or tax avoidance arrangements in place.

Deduction allowed in ascertainment of income

The Bill proposes to amend the Income Tax Act to provide that the following amounts be allowable deductions in the computation of taxable income of individuals; contributions to the Social Health Insurance Fund; the amount deducted in accordance with affordable housing and contributions to a post- retirement medical fund up to fifteen thousand shillings (15,000). These amendments will boost disposable income and enhance employees’ take-home pay.

Ordinarily, pay as you earn (PAYE), has been deducted from the gross income before other statutory amounts are deducted, leaving employees with less take-home. This Bill proposes that in computing taxable income of individuals, SHIF, affordable housing and post-retirement medical fund up to Ksh15,000, shall be deducted before the deduction of PAYE. This will boost disposable income and enhance employee take-home pay.

Expansion of tax-exempt pension limit

The Bill proposes to amend the Income Tax Act to increase the amount deductible in respect to contributions to registered pension or provident funds from taxable income of an individualandcontribution by the employer from Ksh240,000 to Ksh360,000 per year and Ksh20,000 to Ksh30,000 per month.

This aims to boost contributions to registered pension funds for self-employed individuals or those not affiliated with a registered pension scheme. It aims to extend the benefits of enhanced exempt limits to these individuals as they contribute to their individual retirement funds.

Repeal of Affordable housing relief

The Bill proposes to repeal the Affordable Housing Relief in view of the same being made an allowable deduction in section 15.

The Tax Laws (amendment) Bill 2024 proposes to repeal the affordable housing relief applicable to individuals saving for the purchase of a house under an approved affordable housing scheme.

Currently, the relief stands at 15% of employee contribution, capped at Ksh108,000 per year.

It is imperative to note that this relief is different from the relief available for deductions pursuant to the Affordable Housing Levy Act.

This is a clean-up of the relief that is currently available to only persons making contributions towards affordable housing scheme as the Tax Laws (amendment) Bill 2024 proposes to fully allow the contributions to affordable housing scheme for tax purposes.

Read: The Paradox of Taxation: Sacrifice Without Value

>>> KRA Unleashes Key Details in Palm Oil Imports Tax Loss Probe

Leave a comment