taxes

KAM Urges Stable Taxes to Strengthen Manufacturing Sector

Kenya Association of Manufacturers (KAM) has called on the government to maintain stable business taxes, saying predictable fiscal policies are essential to attract...

KRA Seeks Public Views on New Rules to Tax Multinationals

The Kenya Revenue Authority (KRA) has invited members of the public, tax professionals, and business stakeholders to share their views on two new...

Tougher Times Ahead as Govt Plans New Taxes on Fuel and Power

The government has announced plans to introduce new taxes on fuel and electricity starting in 2026 to finance a major energy development programme....

Jimi Wanjigi Blames Govt Borrowing for Kenya’s Credit Crunch

Safina Party leader and 2027 presidential candidate Jimi Wanjigi has stepped up his campaign for sweeping economic reforms, criticising the government’s domestic borrowing...

Inside Tax Proposals Being Pushed by Private Sector CEOs

The Kenya Private Sector Alliance (KEPSA) is pushing for tax proposals in the Finance Bill 2025 to foster industrial resilience, tax efficiency, and...

KRA Revenue Collection Hits One Trillion-Shilling Mark

KRA revenue collection as at November 2023 has hit the one trillion shilling mark after collecting Ksh1.005 trillion as of 30th November, 2024.

The Paradox of Taxation: Sacrifice Without Value

Taxation, when handled properly, is a patriotic act that contributes to the common good. But in Kenya, the lack of value derived from...

KRA Unleashes Key Details in Palm Oil Imports Tax Loss Probe

The Kenya Revenue Authority (KRA) has affirmed that the country did not lose any tax revenue through palm oil imports by Louis Dreyfus...

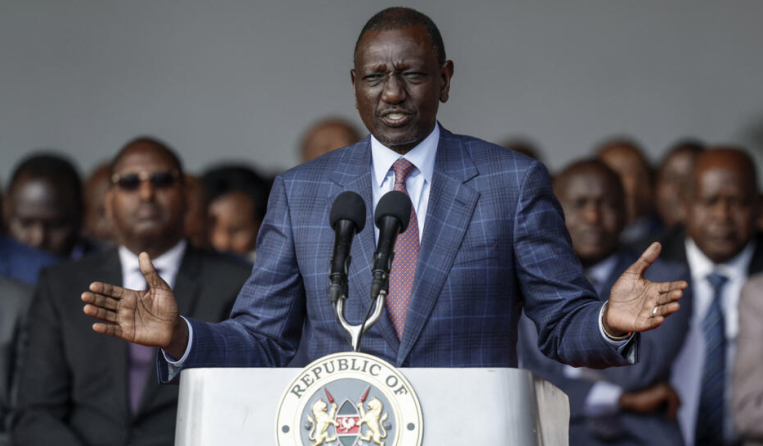

President Ruto, in Shift, Says No to Finance Bill 2024

Kenya’s president, William Ruto, has refused to sign into law the controversial Finance Bill 2024 that imposes high taxes on various goods and...