Paul Russo

KCB Posts 3% Rise in Q3 Net Profit to KSh 47.32B

KCB (Kenya Commercial Bank) Group Plc has retained its top perch as the most profitable lender after it recorded a Net Profit of...

KCB Screens Ksh 578.3 Billion Loans For Environment and Social Risks

KCB Group assessed loans valued at Ksh 578.3 billion for environmental and social risks last year.

Investors Reap Ksh9.6B as KCB 2024 Profit Hits New High

KCB 2024 profit after tax grew by 64.9% to Ksh61.8 billion, accelerated by strong top-line expansion across all businesses. This was a rise...

KCB Takes Major Step to Boost Cross-Border Transactions

KCB Group has signed up to the Pan-African Payment and Settlement System (PAPSS) to enhance cross-border trade and financial integration across the continent.

KCB, MasterCard Deal Sets Pace for Payments in East Africa

KCB, MasterCard have signed a five-year strategic collaboration framework that will see cardholders across East Africa benefit from enhanced value propositions.

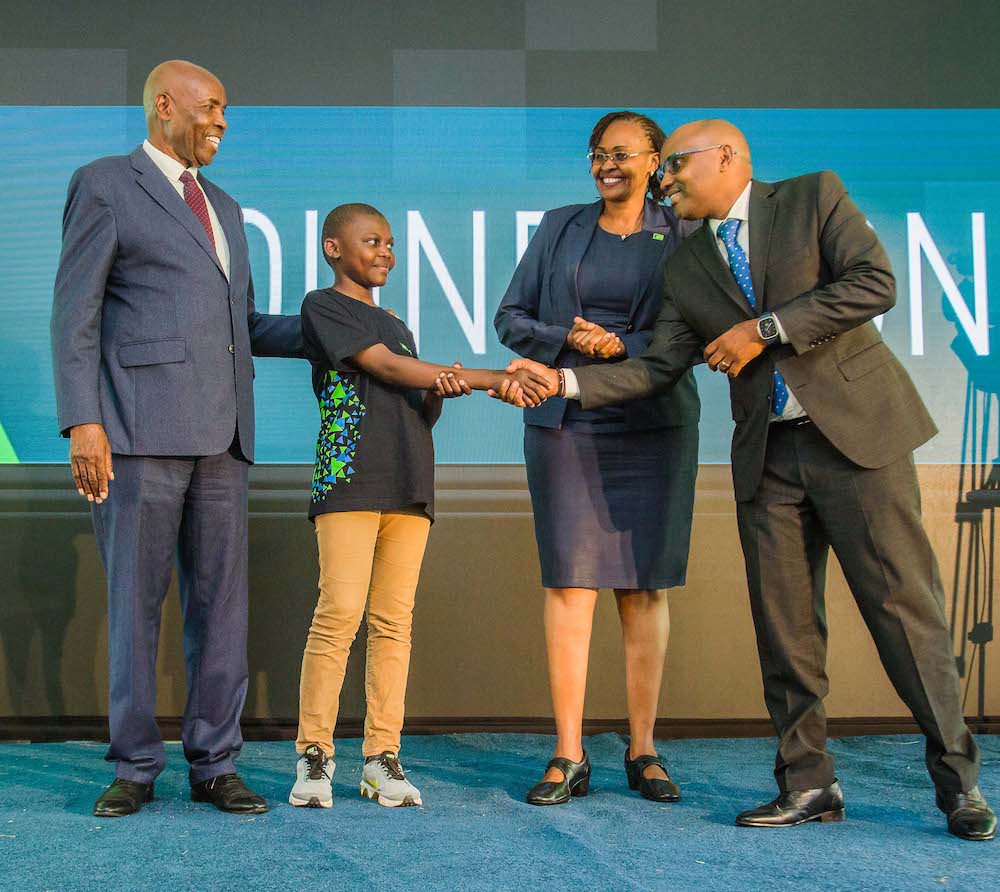

Inside KCB Foundation Scholarships Sh800 Million Fund

KCB Foundation scholarships programme on 17th January 2023 flagged off 1,000 secondary school students for the 2024 scholarship class that will benefit from...

Taking Stock Of The 2023 WRC Safari Rally Success

The WRC Safari Rally catalyzed economic growth by attracting tourists, boosting local businesses, and creating investment opportunities.

KCB Is First EAC Bank To Join Continental Cross-Border Payment Network

The agreement with the Pan-African Payment and Settlement System (PAPSS) makes KCB the first bank in East Africa to implement the financial market...

KCB Group To Pay Shareholders Sh6.4B Dividend

KCB Group shareholders have approved Ksh3.2 billion in final dividend payout for the 2022 financial year.