Saving has never been an easy thing for many people. It’s gets even harder in a society where success is traditionally measured not by how much you have kept away but the amount you can spend in a day or a month.

With banks having reputation issues in addition to low interest rates paid on deposits, Kenyans can be forgiven for splashing their money on luxury or keeping hard-earned cash under the mattresses. It never gets any easier given that you have to carry physical cash line up and fill slips to deposit in many bank-run savings account.

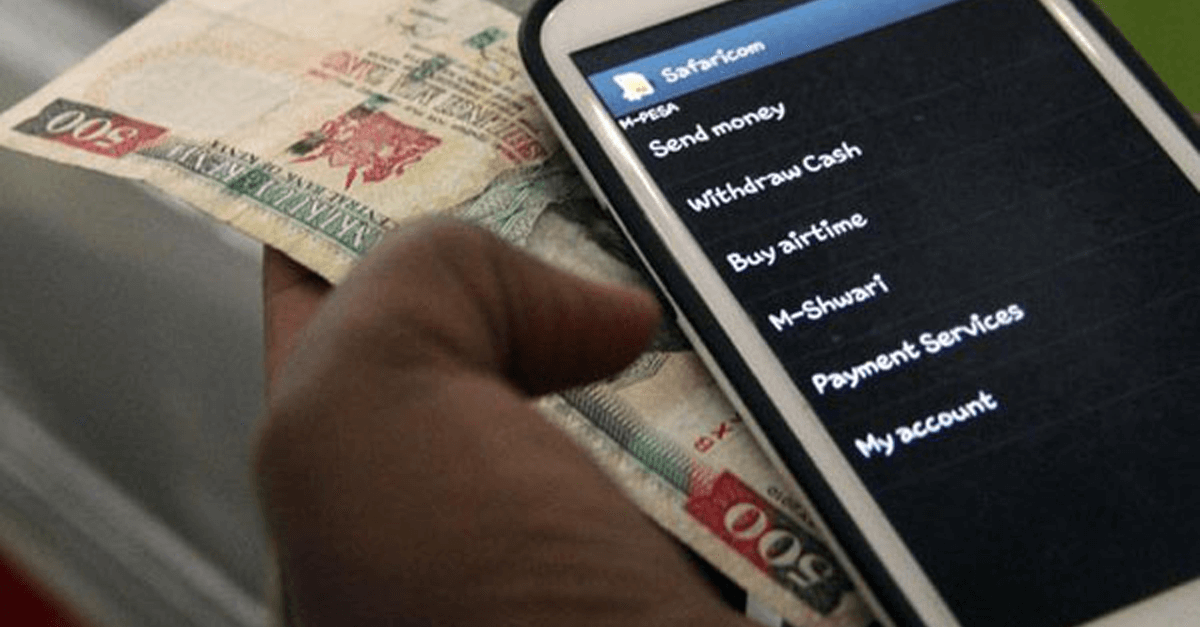

But M-Shwari has made saving easy by bringing savings account in your palms, which enables you to save any time of the day. M-Shwari has made it even sexier by introducing the most exciting way to save in just one year.

The escalation model, dubbed the M-shwari 52-week challenge, is a programme that aims at cultivating a saving culture among Kenyans through the easy to use service. Starting off with just Ksh50 (pocket change for many) on the first week, the target is to hit Ksh68,900 by spreading it throughout the year.

The interesting bit about this model is the fact that it easier to save more as the saving amount increases gradually. It’s easy to execute. You start your week 1 savings deposit on M-Shwari with Ksh50, then Ksh100 the following week, and Ksh150 the week after in that sequence, until the last week of the 12th month where you will save Ksh2,600, and your savings will have added up to Ksh68,900.

This is really exciting challenge that will enable you to achieve what many people have been unable to achieve in many years: save nearly Ksh70,000. The saying saving for a rainy day now makes sense.

[ Read Also: Citizen TV anchor Yvonne Okwara goes back to her radio roots ]

The money can be used for various purposes including taking a holiday, paying school fees, buying household items or as capital to start a business, among others. You can also keep challenging yourself and grow your savings. The icing on the cake is that all the deposits on M-Shwari will earn interest of 6% p.a., way above the average 2% offered by most commercial banks.

Through M-Shwari it’s not just easy to deposit, the money is safe. Another added value to taking up the savings challenge is the fact that the weekly savings increase your M-Shwari loan limit.

[ Next Read: Report shows where the next three million jobs will come from ]

3 Comments