Boda Boda Integrated Management System (IMS) has partnered with Lami Technologies, an insurance tech start-up, to provide affordable motor and personal accídent insurance for motorcycle riders in Kenya. Through the partnership, IMS targets to reach over 2,000,000 riders and 1,515 active Saccos currently registered on its platform.

Boda Boda IMS was founded in 2017 to save lives using road safety technologies. It also seeks to ensure that boda boda riders are safe and secure, orderly, reliable, so they can be transformed into a sustainable public transport business in Kenya. The partnership gives IMS access to affordable and relevant insurance products by Lami’s Insurance as a service and Application Programming Interface (API) platform.

Lami’s indepth experience in the digitization of insurance distribution will also allow IMS riders and Saccos to easily interact with its insurance product, making the process seamless and efficient.

According to an article by The Exchange earlier this year, there are 2.4 million boda boda operators who ride 22 million daily trips earning Ksh1.2 billion daily, making the sector crucial to the economy. Only 30% of the riders have undergone training in a registered driving school, and 65% are not insured.

Affordability is one the biggest barriers to insurance penetration in Kenya. Often riders are required to make a one-off payment and are quoted sums beyond their reach, creating an avoidance of insurance uptake. With this partnership, Lami has negotiated affordable insurance rates with underwriters and insurance providers, allowing IMS to finance insurance premiums and provides payment options such as installments for riders.

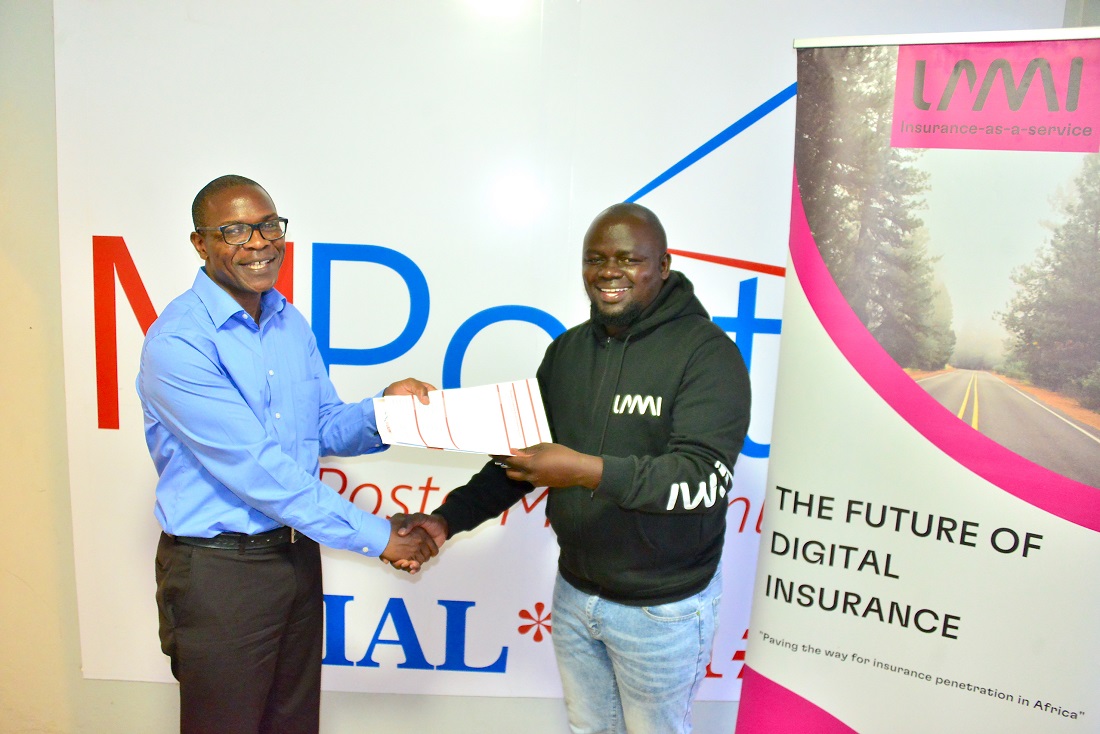

“We have been able to access affordable insurance digitally which has made our work very easy,” said Dr Nick Moseti, CEO, Boda Boda IMS. “Their technology is very efficient and has given us a great and efficient experience.”

Read >> How BuuPass Is Digitizing Public Transport In Africa

Waithera Thinguri, Head of Business Growth, Lami Technologies said boda boda’s are critical to Kenya’s transport system and fill a gap in the absence of reliable, efficient transport in both urban and rural areas. “The solution satisfies a growing need to improve insurance uptake in the country by packaging policies and offering them to clients seamlessly,” Waithera said.

Lami Technologies was founded in 2018 to address the problem of low insurance uptake in Africa. Despite having 17% of the world’s population, Africa is among the world’s most underinsured places. Using technology and innovation, they work with platform partners to create and distribute affordable insurance products to African underserved populations.

Since the inception of the partnership, Lami has onboarded 300 riders to comprehensive insurance. Both companies have worked together to develop a process that ensures motor certificates are issued within five minutes of application.

Next Read >> Maxine Wahome: How Embattled Rally Star Rose To Fame

Leave a comment