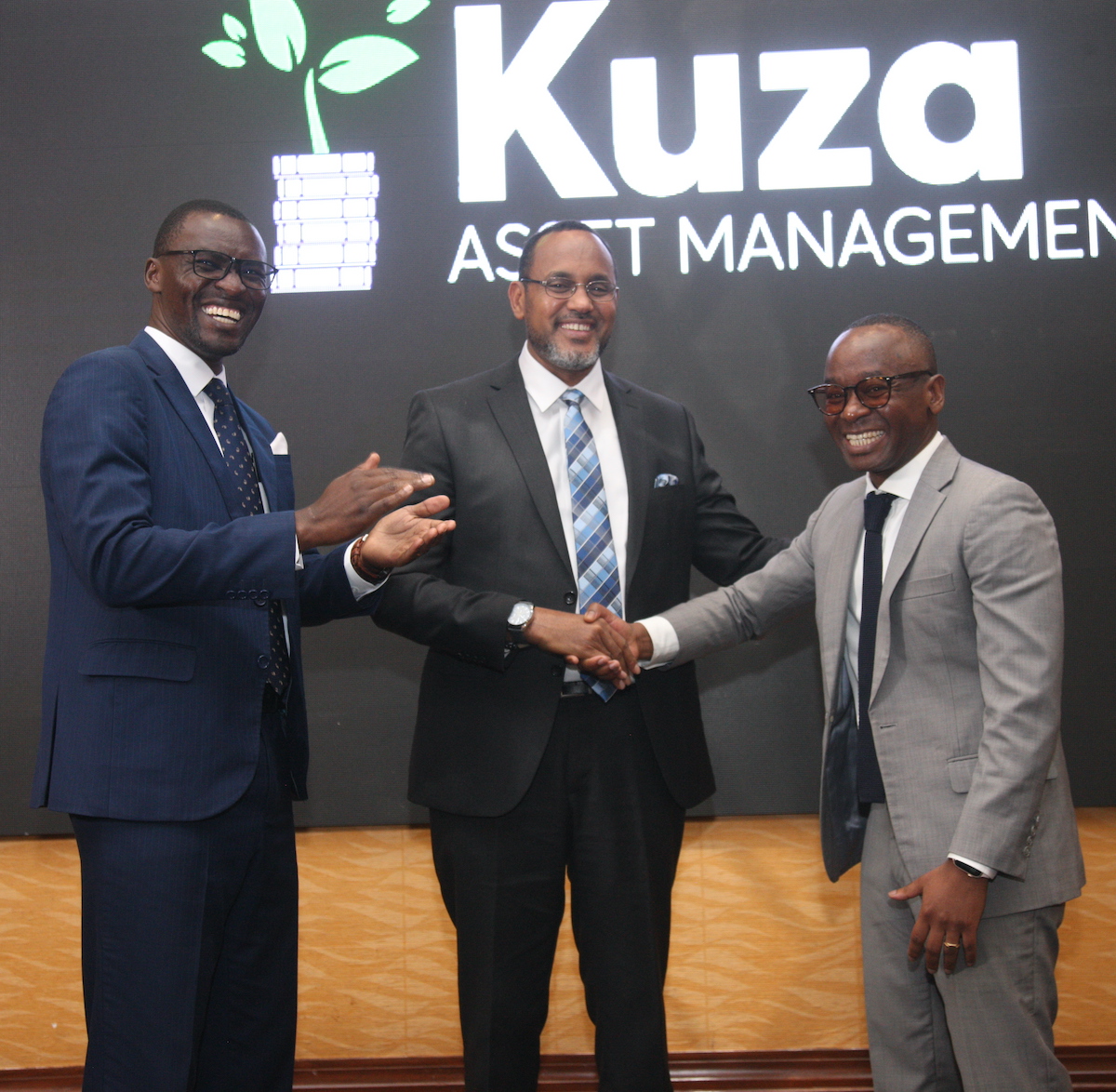

Kuza Asset Management, a Nairobi-based asset management firm, has officially launched and revealed it will focus on catering to institutional, high-net-worth individuals (HNWI) and retail investors.

Founded in 2021, Kuza Asset Management is regulated by the Capital Markets Authority (CMA) and the Retirement Benefits Authority (RBA).

Presently it has over Ksh650 million in assets under management. Kuza Asset Management CEO James Mose, CFA, says the firm is aiming to mobilize the vast, yet largely untapped trillions of funds spread across financial institutions including banks.

“Kenyans have at least Ksh5.3 trillion in deposits of which about Ksh2.1 trillion is in current accounts earning close to zero percent in returns,” Mr Mose says. “The bulk of the Ksh2.1 trillion should be invested in Money Market Funds currently earning investors upwards of 12.5%.”

Mr Mose said with Money Market Funds, funds can be accessed on short notice. The asset management firm is additionally targeting the untapped but promising market for Shariah-compliant investment products.

>> Why Money Market Funds are Investors Favourites These Days

Kuza Asset Management has, in fact, established a dedicated Shariah-Advisory Board tasked with overseeing the development of Shariah-compliant products. The CMA has approved the Kuza Shariah Momentum Fund which is now available to Muslim investors.

The Chairman of the Capital Markets Authority, Mr Ugas Mohamed, says it is an exciting time to see the interest investors have had in collective investment schemes and especially the Money Market Funds. He noted that the sector had great potential to grow from the current over Ksh176 billion assets under management.

Kuza Asset Management also has pension products, unit trusts, a private debt fund and a private wealth management offering. Overall, Kuza Asset Management has 10 products catering to a wide and diverse client base, with more in the pipeline.

>> Safaricom Glides Back to Double-Digit Profit in Half Year

Leave a comment