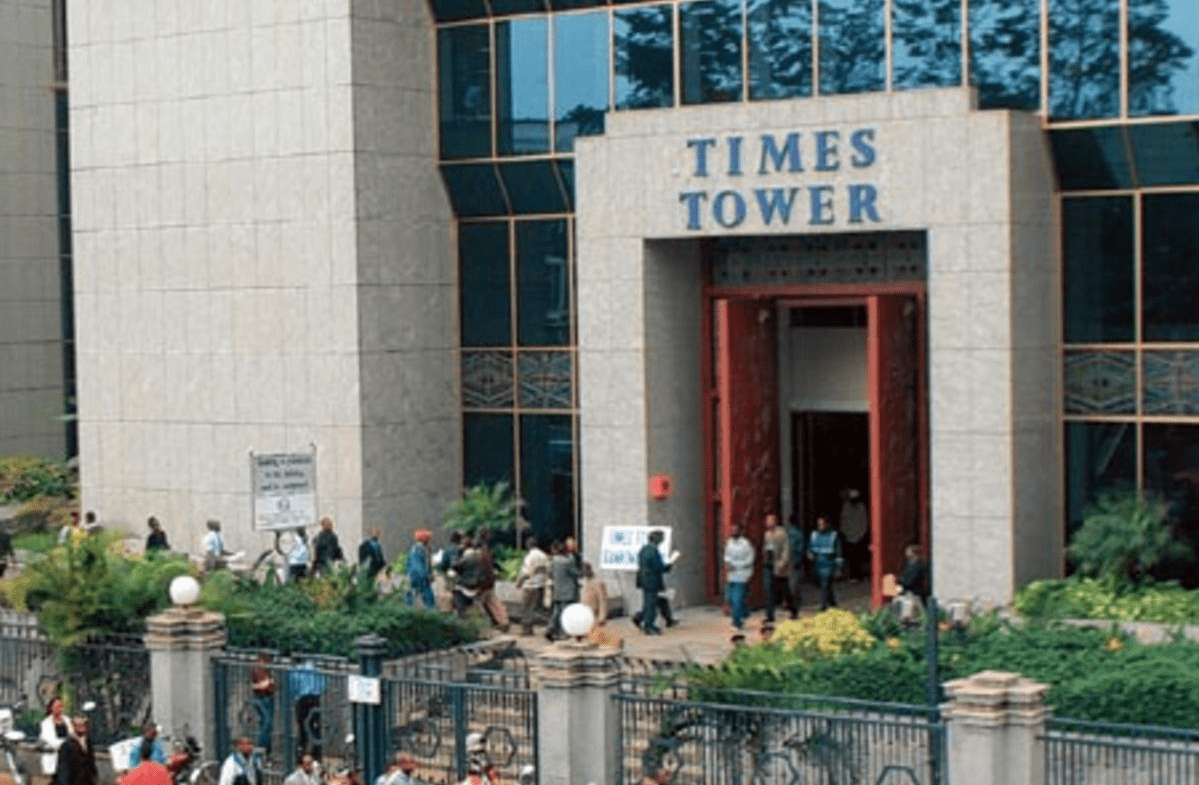

Kenya Revenue Authority (KRA) has launched the annual Taxpayer’s Month to celebrate compliant taxpayers for their patriotic act of dutifully remitting their taxes.

The event, which is organized to appreciate taxpayers for their selfless contribution towards the country’s development agenda, will be marked by a long month of customer-centric activities countrywide.

This year’s celebration is significant with KRA having managed to meet and surpass the Financial Year 2020/21 revenue target after eight-year wait. Despite the prevailing economic circumstances brought about by Covid-19 pandemic, KRA posted exemplary revenue performance of Ksh1.669.2 trillion against a target of Ksh1.652.4 trillion.

“KRA has therefore dedicated the month of October to carry out activities geared towards honouring and appreciating all taxpayers for their invaluable contribution to the government’s revenue collection efforts that enabled Authority to meet the target. The event also acts as a platform to encourage citizens to be tax compliant, fund the national budget and sustain the economy,” the taxman said in a statement.

During the month, KRA will engage in various activities which include; taxpayer appreciation visits, taxpayer education, annual tax summit and Corporate Social Responsibility (CSR) activities. The event will also be marked by Taxpayers Award Ceremony hosted in honour of distinguished taxpayers and officiated by H.E President Uhuru Kenyatta. The distinguished taxpayers will be recognized for their exemplary tax compliance in the year 2020.

This year’s Taxpayers Month is driven by the theme ‘Pamoja Twaweza.’ The theme highlights the collective role and contribution of both taxpayers and KRA towards the current socioeconomic environment.

“KRA calls upon the public to participate in the taxpayers’ month activities. Through participation, taxpayers will have an opportunity to give feedback on various tax issues that will enable Authority to enhance service delivery,” added KRA.

![Karanja accused KRA of hypocrisy as the taxman facilitated KRA with 329.4 million excise stamps for the packaging of Vienna Ice and collected Ksh7.3 billion excise tax for the Crescent Vodka used. [Photo/ File]](https://businesstoday.co.ke/wp-content/uploads/2023/02/bf-1.jpg)

![Anthony Ng'ang'a Mwaura pictured next to President William Ruto at a past function. The businessman, who primarily runs construction companies, is considered a close ally of Ruto. [Photo/ Twitter]](https://businesstoday.co.ke/wp-content/uploads/2022/11/am.jpg)

Leave a comment