The National Treasury has already released the 2025/2026 Budget Statement, which proposes expenditure ceilings for the national government including those of Parliament and the Judiciary, as well as indicative transfers to county governments for the next financial year and the medium term.

Once considered and approved by National Assembly, the ceilings will form the basis for the preparation of the national budget for financial year 2025/2026 as well as form the basis for the Division of Revenue Bill, 2026.

The Budget Policy Statement is anchored on five pillars and twelve enablers. These pillars include Agriculture, Micro, Small and Medium Enterprises, Housing and Settlement, Healthcare, and Digital and Creative Economy.

The 2025 Budget Policy Statement (BPS), which is the third to be prepared under the Kenya Kwanza Administration, highlights the progress made in the implementation of the strategic interventions articulated in the Bottom-Up Economic Transformation Agenda (BETA) and anchored on the Fourth Medium Term Plan of the Vision 2030.

“The Government’s fiscal policy for the FY 2025/26 and over the medium-term places special emphasis on fiscal consolidation to reduce public debt vulnerabilities while providing fiscal space to deliver essential public goods and services. Fiscal consolidation will be supported by concerted expenditure rationalization and revenue mobilization efforts. This will bring public debt on downwards path consistent with Kenya’s debt anchor,” National Treasury Cabinet Secretary John Mbadi says.

“To boost revenues, emphasis will be placed on a combination of tax administrative and tax policy reforms that include: strengthening tax administration for enhanced compliance through expansion of the tax base, minimizing tax expenditures, leveraging on technology to revolutionize tax processes, sealing revenue loopholes and enhancing the efficiency of tax system; and, focusing on non-tax revenues that Ministries, Departments and Agencies can raise through the services they offer to the public.”

“The Government will also sustain efforts to strengthen accountability, transparency and a revenue mobilization path guided by the Medium-Term Revenue Strategy – that makes tax regime more efficient, equitable, and progressive,” he adds.

Ksh4.3 Trillion

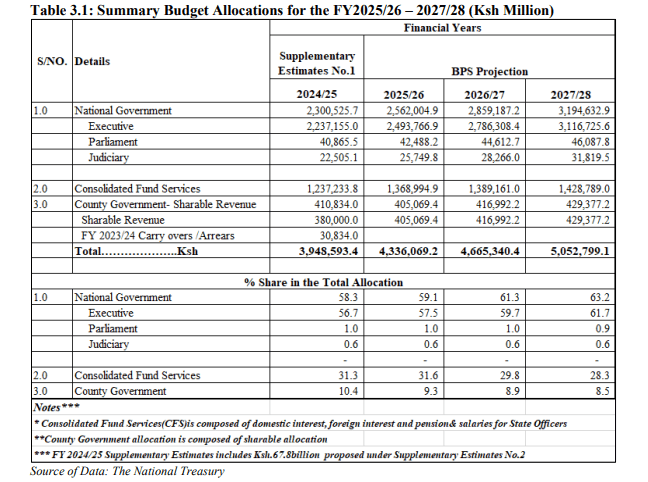

The overall expenditures and net lending are projected at Ksh4.3 trillion (22.1 percent of GDP) in FY 2025/26 from the projection of Ksh3.978 trillion (22.8 percent of GDP) in FY 2024/25.

The FY 2025/26 comprise: recurrent expenditure of Ksh3,096.3 trillion (16.1 percent of GDP); development expenditure of Ksh725.1 billion (3.8 percent of GDP); transfers to County Governments of Ksh436.7 billion and Contingency Fund of Ksh5.0 billion, respectively.

The fiscal deficit including grants is projected at Ksh831.0 billion (4.3 percent of GDP) in FY 2025/26 compared to the projected fiscal deficit of Ksh862.7 billion (4.9 percent of GDP) in FY 2024/25.

The fiscal deficit in FY 2025/26 will be financed by a net external financing of Ksh146.8 billion (0.8 percent of GDP) and a net domestic financing of Ksh 684.2 billion (3.6 percent of GDP.

In the FY 2025/26 total revenue including Appropriation-in-Aid (A-i-A) is projected at Ksh3,385.8 billion (17.6 percent of GDP) from the projected Ksh 3,065.2 billion (17.6 percent of GDP) in FY 2024/25.

Of this, ordinary revenue is projected at Ksh2.835 trillion (14.7 percent of GDP) from the projected Ksh2.581 trillion (14.8 percent of GDP) in FY 2024/25.

What arms of government will receive

Out of the Ksh4.3 trillion, the national government is projected to receive Ksh2.6 trillion, with the executive getting Ksh2.5 trillion, Parliament Ksh42.5 billion and Judiciary Ksh25.7 billion.

Ksh1.4 trillion has been assigned to the Consolidated Fund Services while the county governments will receive Ksh405 billion in sharable revenue.

The National Treasury says resource allocation for the BETA priority programmes will be undertaken through a value chain approach under five sectors namely: Finance and Production; Infrastructure; Environment and Natural Resources; Social Sectors; and Governance and Public Administration.

The nine identified key value chain areas for implementation include: Leather; Cotton; Dairy; Edible Oils; Tea; Rice; Blue Economy; Natural Resources (including Minerals and Forestry); and Building Materials.

“This process ensures there is no break in the cycle in the resource allocations for a value chain. The process will ensure adequate resources are allocated to any entity along the value chain and elimination of duplication of roles and budgeting of resources. Spending in these essential interventions is aimed at achieving quality outputs and outcomes with optimum utilization of resources. The momentum and large impact they will create will raise economic vibrancy and tax revenues,” BPS reads in part.

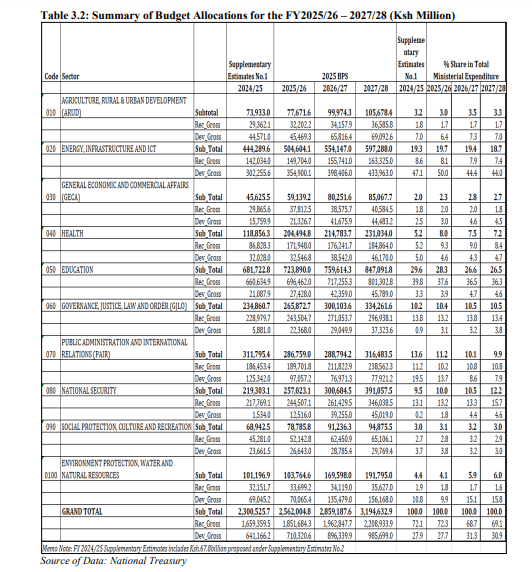

In the budget estimates for the Fiscal Year 2025/2026, agriculture, Rural and Urban Development will get Ksh77.6 billion while energy, Infrastructure and ICT is projected to get Ksh504 billion.

General Economic and Commercial Affairs will get Ksh59 billion, Health Ksh204 billion, Education723 billion and Governance, Justice, Law and Order Ksh265 billion.

Public Administration and International Relations will get Ksh286 billion, National Security Ksh257 billion, Social Protection, Culture and Recreation Ksh91 billion while Environment Protection, Water and Natural Resources get Ksh103 billion.

Read: Farming Experts Dig in For Higher Budgetary Allocation to Farming

>>> ‘No More Payslip Raids Under My Watch’ – CS John Mbadi Promises

Leave a comment