The notorious effects of volatility touch off debate on price differences in cryptocurrency. Digital money cannot aim to have a condition in a market that brings stability to the currency. There is no way the currency can ever reach the objective of having an average circulation without the difference in money price.

The volatility is another reason behind the different market capital for every currency. Each individual is using Bitcoin qs knows more about Bitcoin and other cryptocurrencies than the other who only targets the unit through the use with minimum knowledge. The latitude of a cryptocurrency in the economy has increased the ground support. Bitcoin in 2021 was more volatile with changes of 300%. The volume of fluctuations witnessed in Bitcoin has generated debate and people started thinking about many other reasons.

Other Reasons For Bitcoin To Gain The Value

Volatility crosses the mind when everybody thinks about the changes in prices. Over time holding crypto money has become easy as people have found the shortcut for emérgency purposes and short trading. Preference is primarily extended to the people who can propose the difference in the currency and not occasionally opt for the currency.

Bitcoin is not an occasional currency that gives the economy the purpose. But it is a generator of income that can quickly bring millions of dollars without intensive service. Usually, the wide circulation of the currency is due to the destructive effects of United States dollars and the decreasing standard of yellow gold. Cryptocurrency is a young currency that can have a huge impact in the market.

But the yellow metal has been standard for centuries. In the beginning, it was utilized by the country’s rulers to circulate for the happiness and growth of citizens. While afterward, the bank collected the yellow metal as a reserve to create a standard for the commercial banks. Now people purchase gold to create a standard in society.

Everywhere the purpose of gold is to give the standard to the individual and the ruling party. But Bitcoin is different; it does not give a standard to a particular person but to the entire economy. So there is a gap between fully completing ordinary people’s dreams and the economy. Yellow gold cannot satisfy a person’s desire because every time the metal is purchased, people feel upset about not purchasing more because the value remains indifferent.

Although currency fluctuates in the market because of less mining from the Arabian countries or heavy taxation on transportation, the value does not go above the limitation set by the government at any cost. In contrast, Bitcoin does not have a demotion for a long time but a promotion in its price.

Overview On Bitcoin

Currently, the currency market faces valuation debate from the people who want to know about the process. Certainly, the purpose is finding the similarity and the historical identity of valuations and overview in the currency with the growth as the ultimate objective. Moreover, the currency is currently the economic driving force that brings the supply of money and tough competition.

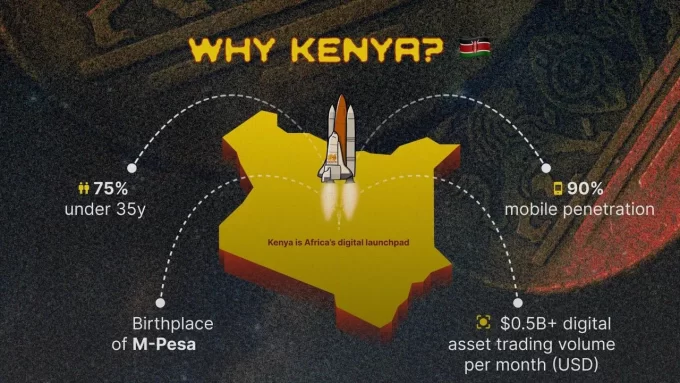

Read >> Kenyan Minister Who Invested Heavily In Bitcoin

Bitcoin has no limitations from the blockchain technology, and the transaction area across the world has multiple applications to facilitate. However, the country’s finance requires a gatekeeper to eliminate the problem from the international transaction, which Bitcoin can perform wonderfully if the government gives the support. Blockchain technology does not want to confront the government policy but wants to satisfy the situation by creating its charges and terms.

The cryptocurrency has realized success in reducing the liability of any government by giving them the benefit. Volatility is just a condition that is easily calculated by the strategies and the analytic tools available.

Final Verdict

Bitcoin is scoring in finance by winning the faith of individuals who believe in digital money’s legal system. The currency is not only landing the support of government in financing but also giving mass adoption to the private companies.

Next >> Complete Guide To Bitcoin Investment For Beginners

Leave a comment