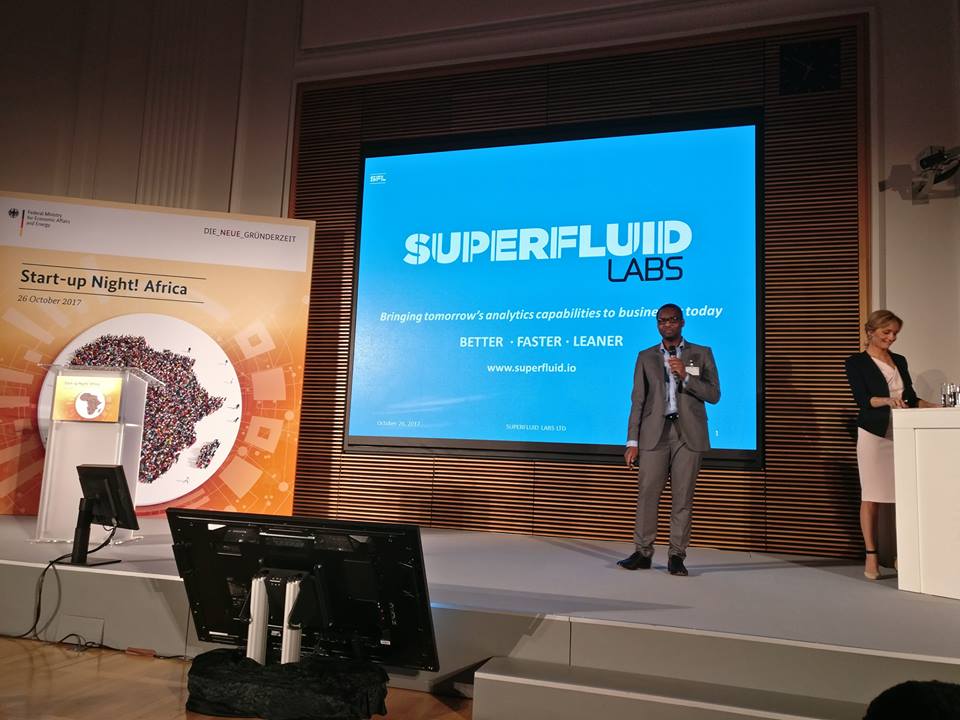

GreenTec Capital Investments has announced its investment into SuperFluid Labs, a Kenyan-based Software as a service (SAAS) provider of data analytics and artificial intelligence solutions. SuperFluid has developed a comprehensive data analytics platform that can assess credit scores and provide business intelligence more effectively through Big Data and artificial intelligence.

The SuperFluid team consists of data scientists, engineers, and mathematicians; who have built a proprietary technology platform that mines customer transactional data to automatically reveal customer behaviors and trends (e.g. credit risk and defaults), as well as, helping institutions to enhance engagement, reduce churn risk, and increase overall profitability. The company’s mission is to bring AI to businesses and consumers to drive economic growth and opportunities.

The company has already established a successful consulting business providing their analytics services to MFIs such as responsAbility, as well as traditional banks like Fidelity Bank (Ghana) and NIC Bank (Kenya) to name a few. Next, SuperFluid plans to expand their offerings targeting e-commerce clients, helping businesses to offer their own credit services to qualified customers. Capturing transactional data from multiple sources will further allow SuperFluid to develop robust market-focused credit scoring models.

“This will provide the company with a competitive advantage over international agencies which do not have models customized for African markets and over Africa-based scoring companies that are limited by their regional presence. Through providing bespoke analytics to banks, eCommerce platforms, and MFIs the company plans to offer a Pan-African credit scoring solution help expand financial inclusion to millions of Africans as well as empower African businesses to harness the power of Big Data to improve their business decisions,” GreenTec said in a statement.

READ: KENYAN FILM MISSES OUT ON THE OSCARS

SuperFluid Labs was founded in September 2015 by Timothy Kotin, a member of the privileged subset of African startup founders who run businesses in two prominent innovation hubs in East and West Africa, while being plugged into Western Europe’s more developed tech ecosystem.

GreenTec Capital is a Frankfurt, Germany-based investor in African startups and SMEs.

1 Comment