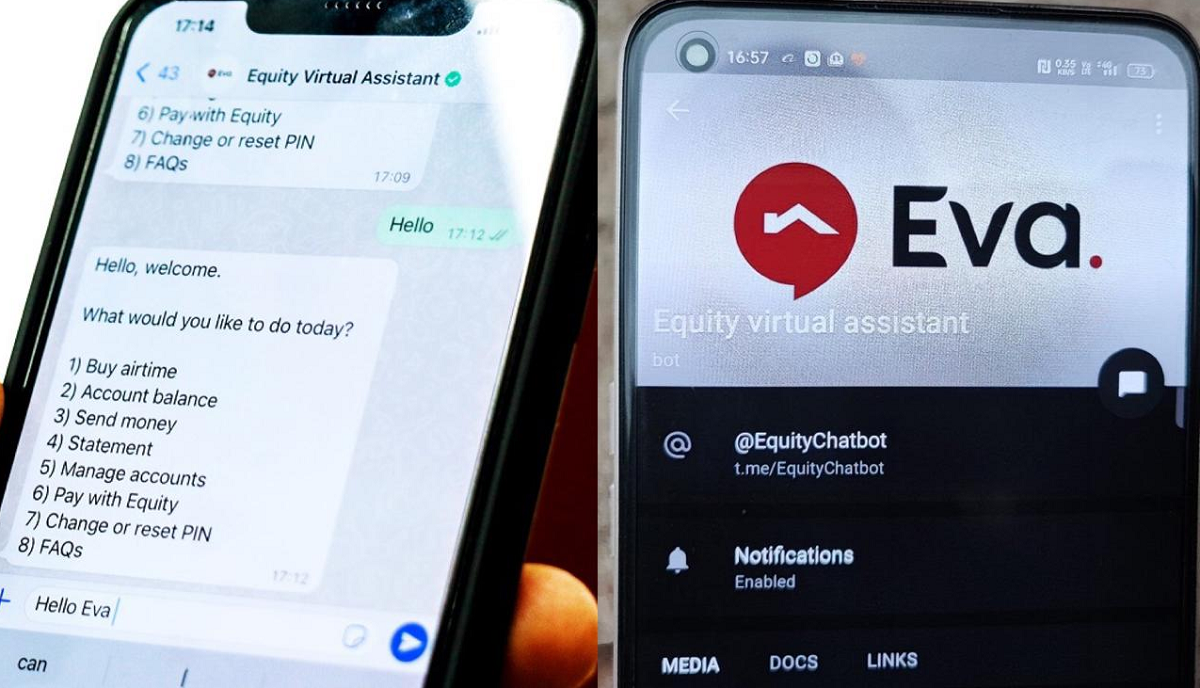

Equity has introduced Equity Virtual Assistant (EVA), the bank’s chat banking platform that takes financial services to the next level by presenting banking transactions as virtual conversations on social media platforms including WhatsApp, Facebook Messenger and Telegram. The EVA chatbot replaces EazzyNet service.

See >> I&M Group Q1 Profit Soars To Ksh2.7 Billion

EVA chatbot extends digital banking and customer support services to existing and new customers and can simulate a conversation (or a chat) with a user. The experience is as easy and natural as having a conversation with a friend. Customers can now manage their accounts on EVA and engage with the virtual assistant to make transactions like buying airtime, sending money, buying goods and services, paying bills, viewing account balances, and getting a statement within their social media platform.

“We are more than a bank, we are an enabler of lifestyle, fulfilling the needs and aspirations of our customers and communities,” said Equity Group Managing Director and CEO, Dr James Mwangi. “The launch of Equity Virtual Assistant, EVA, is in line with our journey to make our services and products available virtually and online.”

Using Artificial Intelligence, EVA is expected to evolve and learn from the interactions it has with customers to provide responses. The new Equity Virtual Assistant seeks to improve customer experience and streamline banking processes. EVA Chatbot is inspired by Equity’s investment in advanced technologies such as Artificial Intelligence, Machine Learning, Robotics Process Automation and Advanced Analytics.

These technologies converge to create new and improved experience for customers who can now access banking services without leaving their favorite social messaging apps. This adds to the innovations that have continued to drive Equity’s business transformation enabling it to transition from fixed cost to third party variable channels and self-service platforms.

These innovations saw the Bank’s transactions on mobile, internet, and third-party channels rise to 97.1%, in the first quarter of 2022, as compared to only 2.9% of transactions happening in physical branches and ATM outlets over the same period last year.

Read >> Government Begins To Roll Out Digital Medical Services

According to 2020 data on Social Media User Trends from Global Web Index, Kenya has the highest percentage of monthly WhatsApp users compared to the rest of the world, with 97% of the country’s internet users active on WhatsApp. Cumulatively, Kenya has about 11.75 million active social media users. This presents a unique opportunity for the Bank as it continues to develop innovative products to drive its digitization agenda on all customer touchpoints.

Equity has enhanced customer journeys and experience, enabled additional banking transactions and updated security features on EVA, providing secure banking and real-time response on a range of questions related to the Bank’s solutions and services.

Read >> KCB Group Picks Insider To Replace Joshua Oigara

Leave a comment