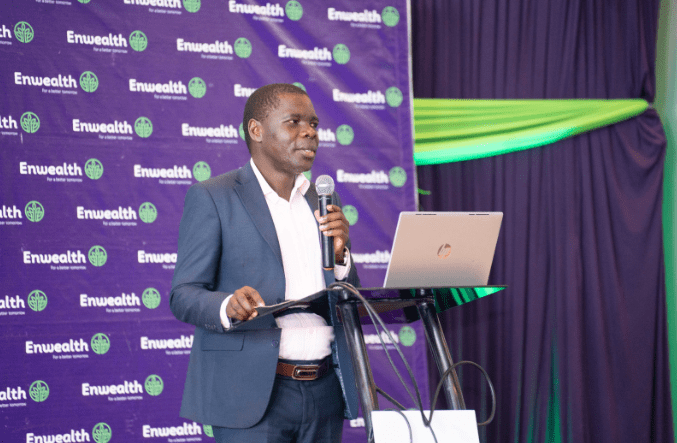

Enwealth Financial Services, which is celebrating 14 years of growth, impact, and resilience in empowering Kenyans to achieve financial security today hosted a breakfast briefing for its clients providing a platform to discuss critical issues shaping pensions and the broad financial sector.

One of the critical issues discussed by the players convening such as the Retirement Benefits Authority, pension funds, policymakers, financial experts, and industry leaders was the recent tax reforms under the Tax Laws (Amendment) Act 2024 which came into effect in December last year. According to experts at Enwealth, the tax amendment signals a new era of retirement security with its strong focus on financial security and healthcare planning which will empower savers and enhance the sustainability of the pension system.

Emerging from the discussion as one of the most impactful changes introduced by the Act is the increase in the tax-deductible pension contribution limit which translates to lower Pay As You Earn (PAYE) liabilities, as higher pension contributions will now be tax-free. The ceiling has been raised by 50%, from KES 240,000 to KES 360,000 annually (KES 30,000 per month), a long-overdue adjustment that accounts for inflation and rising living costs. This means that Kenyans can now save more for retirement without significantly reducing their disposable income.

John Keah, the Assistant Director of Market Conduct and Industry Development at Retirement Benefits Authority (RBA), noted: “The government has taken a significant step toward increasing pension adequacy and protecting the value of pension savings over time by aligning tax policy with current economic conditions. The increase in tax-deductible contributions encourages a stronger retirement savings culture and also provides a solution for the long-standing problem of pension adequacy”.

Another major reform in the Act is the introduction of tax-deductible contributions to post-retirement medical funds. Previously, although post-retirement medical funds existed, their contributions were not deductible from the saver’s taxable income. With healthcare costs becoming an increasing burden for retirees, the new provisions that allow contributions of up to KES 15,000 per month to be tax-deductible have been approved. This move provides an immediate tax relief benefit while promoting long-term healthcare planning for retirees.

According to the Enwealth CEO, the integration of healthcare savings into retirement benefits ensures that Kenyans can retire without the looming fear of overwhelming medical expenses: “The ability to set aside funds specifically for healthcare will help retirees access quality medical services without financial strain, ultimately improving retirees’ quality of life in retirement.”

In addition to these tax benefits, the Act also grants a full tax exemption on pension benefits under certain conditions. Individuals who reach the official retirement age, withdraw due to ill health, or have been members of a retirement scheme for at least 20 years will no longer have their pension benefits taxed.

This reform ensures that retirees can fully enjoy the savings they have built over their working years without the burden of taxation. Encouraging long-term savings by setting a minimum 20-year membership period before tax exemption eligibility also discourages premature withdrawals, helping maintain financial stability in retirement. Furthermore, the exemption for individuals who withdraw due to ill health provides a much-needed safety net for those facing unexpected medical challenges.

Other notable changes improve efficiency in the retirement benefits sector, the Act has also simplified the registration process for retirement funds. Previously, schemes had to register with both the Kenya Revenue Authority (KRA) and the Retirement Benefits Authority (RBA) to qualify for tax exemptions. This dual-registration requirement has now been eliminated, with registration solely under the RBA now being sufficient.

“Streamlining these (registration) processes aims to reduce bureaucratic delays, enhance regulatory oversight, and improve operational efficiency within the sector. This change reinforces accountability, ensuring that retirement funds are properly managed while making it easier for retirement schemes to operate within a clear and transparent regulatory framework.

Read: Enwealth Hosts Kenya’s First Investment Expo For Retail Investors

>>> Enwealth Umbrella Fund Gets RBA Approval To Receive NSSF Tier 2 Contributions

Leave a comment