Diamond Trust Bank’s (DTB) Group pre-tax profit grew 8% to Ksh 2.9 billion in the first quarter of 2019 according to just released results.

The Group defied a tough operating environment to build customer deposits to Ksh 275 billion, while the asset base grew to Ksh 370 billion entrenching the DTB’s position as a leading, tier one bank in Kenya and the wider East African region.

On the back of an industry-wide subdued growth in loans, the group’s investment in Treasury Bills and Treasury Bonds grew to Ksh 124 billion at the end of March 2019 compared to Ksh 118 billion at the same time last year.

DTB’s non- performing loan book declined marginally to Ksh 12.4 billion, from Ksh 13.2 billion a year earlier, with provisions for loan losses reducing, from Ksh 697 million in March 2018 to Ksh 268 million in the first quarter of 2019.

“Year on year, the asset base for the Group continues to grow with total assets closing at Ksh 370 billion at the end of the first quarter of this year,” said DTB’s Managing Director Nasim Devji.

“Our focus on the SME sector, in particular, and commitment to enhancing access and convenience for customers through our branch and agency banking networks and alternate, digitally- anchored channels has helped support our growth,” she added.

At the recently held Think Business 2019 banking awards ceremony, the bank scooped first place position as the Best Bank in Product Innovation and Best Bank in Retail Banking. It also secured runners up position in the Asset Finance, Customer Centric Bank, SME Banking and Agency Banking categories.

“The achievements are riding on the crest of technology-powered and innovation- driven payment solutions aimed at addressing the needs of small and medium enterprises who form part of the supply chain to large corporate businesses in Kenya,” said Ms Devji.

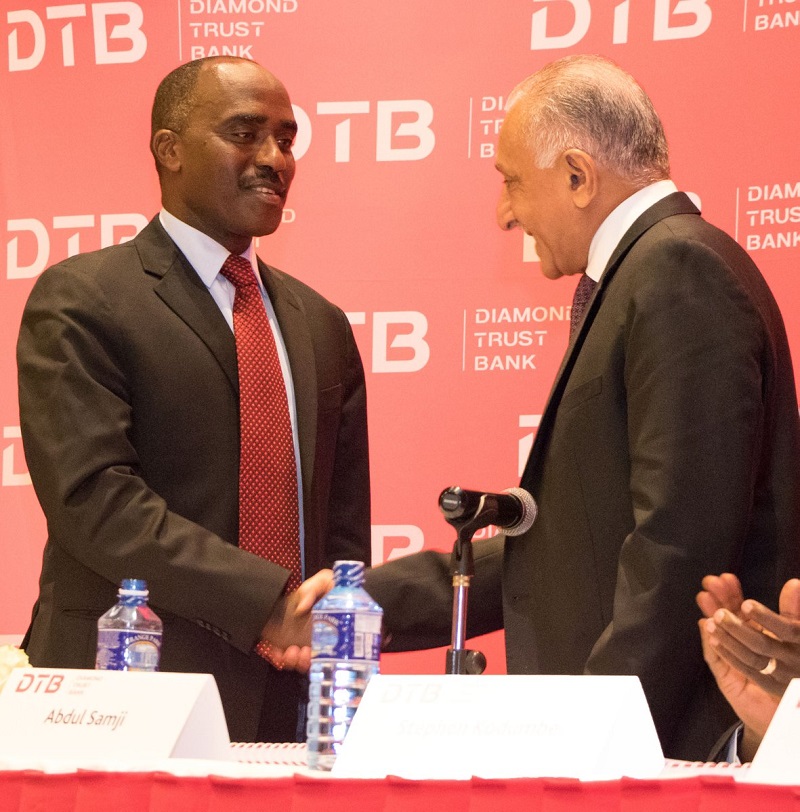

The results were released days after shareholders approved the appointment of Linus Gitahi, 56, as the new board chairman at the Annual General Meeting held on Thursday last week following the retirement of Abdul Samji who had served in the position for nine years.

Leave a comment