The Capital Markets Authority has granted consent to ABSA Asset Management Limited for the registration of Absa Unit Trust Funds which comprise of the 5 Funds namely; Absa Shilling Fund, Absa Dollar Fund, Absa Bond Fund, Absa Equity Fund, and the Absa Balanced Fund.

In a statement to newsrooms on Wednesday, the Authority noted that the approval to register Absa Unit Trust Funds was issued in accordance with section 30 of the Capital Markets Act and Part II of the Capital Markets Collective Investment Schemes Regulations, 2001.

According to the Capital Markets Act, a collective investment scheme includes an investment company, a unit trust, a mutual fund or other scheme which is incorporated or organized under the laws of Kenya which collects and pools funds from the public or a section of the public for the purpose of investment; or is managed by or on behalf of the scheme by the promoter of the scheme.

ABSA Asset Management Limited is a fully owned subsidiary of Absa Bank Kenya PLC.

In October, CMA allowed Pezesha to operate its debt-based crowdfunding platform in the Kenyan capital markets, after a successful one-year testing period in the regulatory sandbox.

A crowdfunding platform is a website that allows firms and entrepreneurs to raise and collect funds from investors, contributors, and donors.

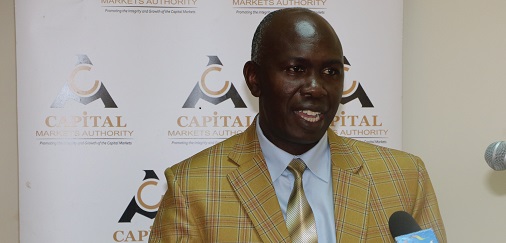

CMA Acting Chief Executive Wyckliffe Shamiah noted Pezesha effectively tested its crowdfunding innovation and achieved its testing objectives and control boundaries between July 2019 and July 2020.

“This positive outcome is a clear demonstration of the unique opportunities arising from the sandbox environment and potential for scaling up innovative ideas. The success of Pezesha’s testing phase underlines the Authority recognition of the need to nurture innovations that can transform the fundraising model in the capital markets,” CMA Acting Chief Executive Wycliffe Shamiah said in a statement.

Alternative capital raising initiatives including crowdfunding platforms provide a different way to raise funding for large companies, small enterprises, and retail borrowers through equity, debt, or a hybrid model.

“CMA is firmly committed to review and adopt global best standards and monitor the growth and activities of the crowdfunding space in Kenya,” said Mr. Shamiah at the time.

Leave a comment