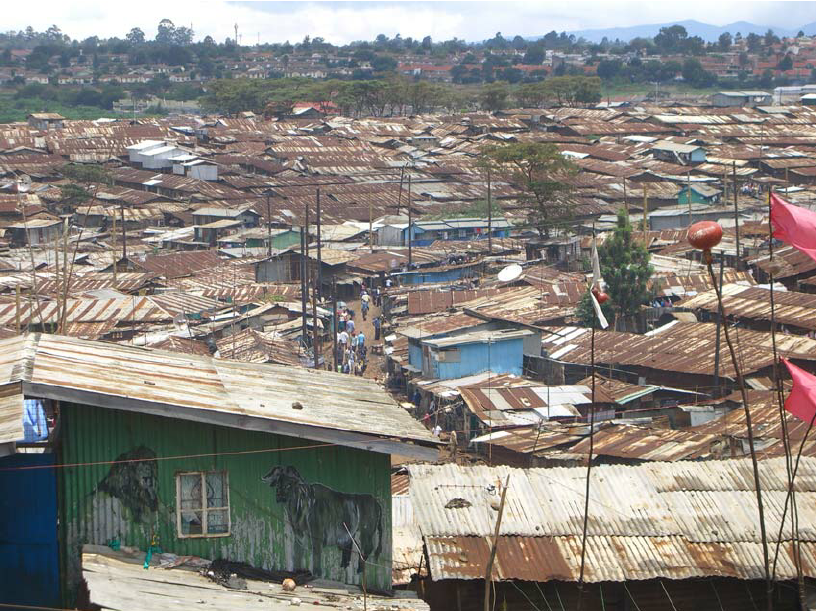

CFK Africa, an international nonprofit with offices in Kenya and the US, is launching a microgrant pilot program in Kibera, the country’s largest informal settlement, to support entrepreneurs in building community economic resilience.

“We have a longstanding saying that talent is universal, but opportunity is not,” said Jeffrey Okoro, CFK Africa’s education and livelihoods program coordinator. “This new initiative will help entrepreneurs who just need a small boost to get their businesses off the ground, especially in the wake of the coronavirus pandemic and with high inflation in Kenya.”

Due to the highly competitive nature of Kenya’s formal job market, most residents in the communities where CFK Africa works are employed in the informal sector and often have unstable incomes. The new program aims to improve the quality and ease of doing business in informal settlements and create more income-generating opportunities, leading to greater economic stability for aspiring entrepreneurs and their families.

In line with the organization’s model of participatory development, the initiative was developed in response to a community-identified need. Residents in informal settlements where CFK Africa works have long expressed interest in a program like this to build economic resilience. The initiative is even more relevant as small businesses and aspiring entrepreneurs struggle as high inflation in Kenya has increased the cost of living.

The new microgrant initiative is also inspired by CFK Africa’s co-founder Tabitha Festo, an unemployed nurse and widowed mother in Kibera who established its first medical clinic out of her 10-foot-by-10-foot home with a grant of just $26. Festo’s dedication to community service laid the foundation for CFK Africa’s primary healthcare work, which now serves more than 50,000 patients every year.

CFK Africa believes that other community leaders can have a similarly large impact, if they have access to the resources to get started. As a nod to its roots, the organization’s microgrant pilot program will provide grants of up to $2,600 to community members with strong business proposals.

“Microgrants are built on the idea that those in financially vulnerable situations know how to solve their own problems best, and that big things can come from small things,” added Okoro. “Programs like this can help residents of informal settlements create their own pathways out of poverty and build a more financially secure future.”

Read: Inflation Forces Migrants to Reduce Remittances

>>> CBK Grants License To DPO Group As Payment Service Provider

Leave a comment