Like other money market funds, Lofty Corban Money Market Fund is a type of mutual fund that invests in debt securities of short maturities and minimal credit risks, such as Treasury bills, bank deposits, corporate debt and repurchase agreements that are collateralized fully with government securities, so they are low risk, but not risk-free.

Lofty-Corban Investments Ltd, a leading Kenyan investment management firm specializing in managing Collective Investment Schemes and Pension Funds, owns the Fund. KCB Bank is its trustee, and Equity Bank is the custodian.

Lofty Corban Money Market Fund seeks to provide security of principal, high current income and liquidity by investing in those short-term money market instruments mentioned at the start.

> Top 5 Best Money Market Funds in Kenya (2024)

Many investors use money market funds to store cash because they pay higher returns than interest-bearing bank accounts.

What is the interest rate of the Lofty Corban Money Market Fund?

As of June 2024, Lofty Corban is offering the best interest on money market accounts in Kenya at 18.31% nominal rate, compared to 18.27% last month and 17.96% in March.

The interest is usually compounded daily and credited monthly but is subject to a 2% annual management fee as part of fund expenses.

Therefore, for example, during March, when the standard nominal rate was 17.96%, the effective interest rate dropped to 16.43% upon deducting all the expenses incurred by the investment manager for management and administration of the Fund.

What is the minimum amount to open the Lofty Corban Money Market account?

The minimum opening deposit for a Lofty Corban Money Market Fund account is Ksh1,000, but beyond the initial deposit, there is no requirement to maintain a minimum balance.

However, there is a minimum additional investment amount, which is Ksh100.

How to open a Lofty Corban MMF account

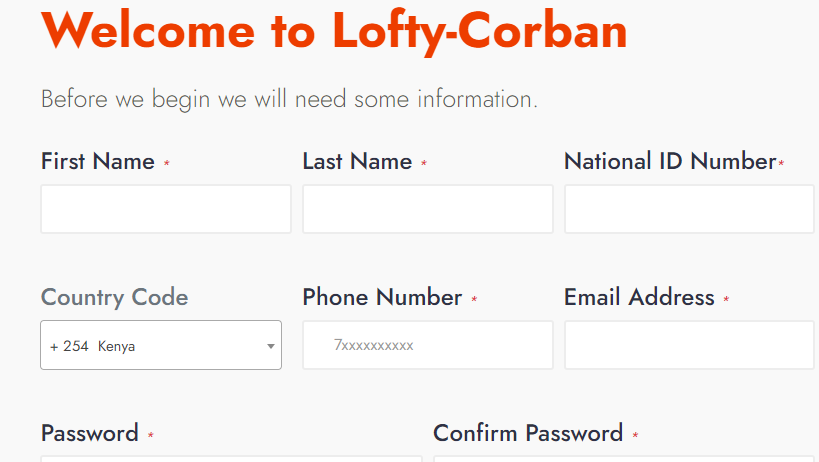

If you are in Kenya, you can register a Lofty Corban Money Market Fund account online as long as you have acceptable proof of identity and all the required documents, like a tax certificate.

Here’s what you’ll need to do to open an account online:

1. Visit their website at loftycorban.com

2. Click on ‘CREATE ACCOUNT’ in the top navigation menu

3. Complete your personal information following the online prompts

4. Fill in your employment information, bank information and beneficiary and next of kin details

4. Upload a copy of your identity and address documents

5. Submit

It will take one day for your account to get verified and activated. When you open a Lofty Corban Money Market account and start investing, your money is automatically insured, and there is no need to apply for insurance separately because Lofty-Corban Investments Ltd is regulated by the Capital Markets Authority (CMA).

Read: NCBA Money Market Fund Review 2024

I would like to open an account

Where are your physical office,can I visit you

Interesting in your money market

Where do you deduct the 2% management fee?

Can I access my money anytime I want?