Mwananchi Credit Limited has announced an ambitious plan for a nationwide branch rollout to widen credit access to thousands of Kenyans especially in the additional product line of Title Deed Loans.

The micro-finance company , headquartered in Nairobi, currently has three branches in Nairobi, and one each in Kitengela, Thika, Mombasa, Eldoret and Kisumu. The expansion will be driven by a branch-per -country strategy that will see the micro-finance institution increase its presence in all the 47 counties.

Some of the regions it is likely to set up base include Mount Kenya (Meru, Embu and Nyeri), Western region ( Kakamega, Bungoma and Kitale), Nyanza (Kisii, Homa Bay and Migori) and Rift Valley (Nakuru and Naivasha).

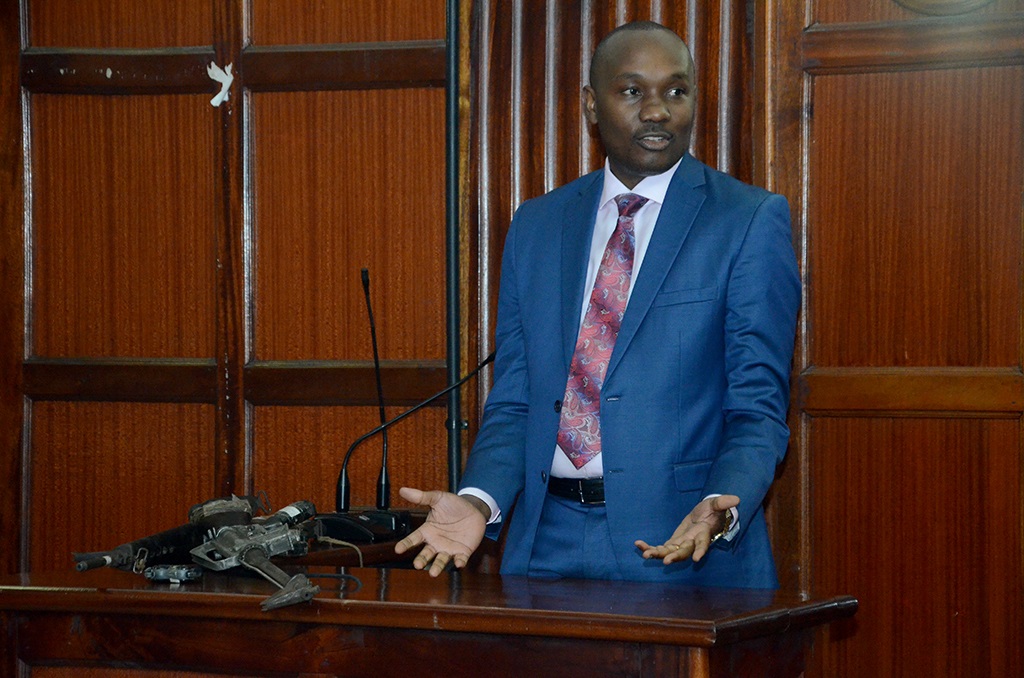

Speaking during the countrywide rollout strategy meeting, the company’s CEO Dennis Mombo said: “At Mwananchi Credit, we seek to get our services to the people by being as close to them as possible. Having offices closer will mean better decentralized services to Kenyans and will enable them access a wider array of our services.”

Mwananchi Credit is one of the leading logbook loan providers in the country. It has diversified its product offering to include title deed loans, salary check off loans, import financing and asset finance among others.

The micro-finance institution has been awarded Best Logbook Loans Provider in Kenya for its innovative approach to lending.

Leave a comment