NAIROBI, Kenya

UAP Life managed pension fund outperformed the stock market to return a 13 per cent interest to its members in the financial period ending December 31st 2102, more than double the 5 per cent that the firm registered in the financial period ending December 2011.

UAP Investments General Manager Anthony Mwithiga said during a briefing to trustees that the firm had posted the highest interest on members’ funds at 13 per cent, which was higher than the industry average of 10 per cent. He attributed the performance of the fund to a stronger focus of investments in the bonds asset class, a departure from previous years’ investments in the equities class.

“Due to the volatile nature of the equities market over the last five years, we believe that the bonds assets class offers a better and more consistent return for our members,” said Mwithiga adding that three of the last five years have been bearish for the local stock market, much in line with global trends while the 5-year average return has been -1.064% despite strong double digit returns in 2010 and 2012 at 36.49% and 28.95% respectively.

UAP allocated the largest portion of the fund to bonds constituting 59 per cent of the total Ksh 2.3 billion it held during the year. As a retirement fund and in compliance with the Retirement Benefits Authority Act, he said that the fund had allocated 21 per cent to property, while the money markets and equities had attracted 5 and 16 per cent respectively. Mwithiga explained that UAP Life was very confident that the prevailing economic indicators will continue into the coming year. “We expect the positive momentum and investor sentiment to prevail into 2013 based on improved macro-indicators and peaceful outcome of the recent general elections,” he noted.

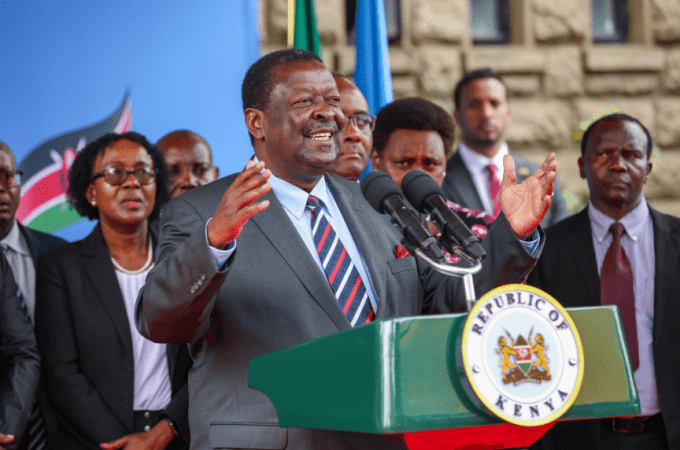

He also outlined the expectations that liquidity would remain high, at least in the first half of 2013, which in turn will keep Treasury bill interest rates low. At the same time, primary bond issues or new issuances will continue to drive value in the bond markets in the first half of the year. Speaking at the same briefing, Jerim Otieno, Managing Director UAP Life decried the low rate of retirement saving among Kenyans and warned that most of the people retiring in the next ten to fifteen years will end up in homes for the elderly as their children will not be able to look after them. He added that the firm had appointed Centum Investments to be the Fund Manager and was eying the possibility of investing members’ funds in private equity as these had better returns.

Otieno called on companies to adopt the concept of outsourcing their pension fund trustee services to specialist firms to free them from incurring the administrative costs that came with having staff act work as occupational fund trustees. Known as Umbrella Pension Schemes, he noted that this was the new trend in pension fund management which is more affordable and offers the staff fund opportunities of their collated funds having access to stronger assets classes, the ability to negotiate better interest and even the emerging possibility of investing in private equity.

The writer is a communications student at United States International University – USIU Kenya

Leave a comment