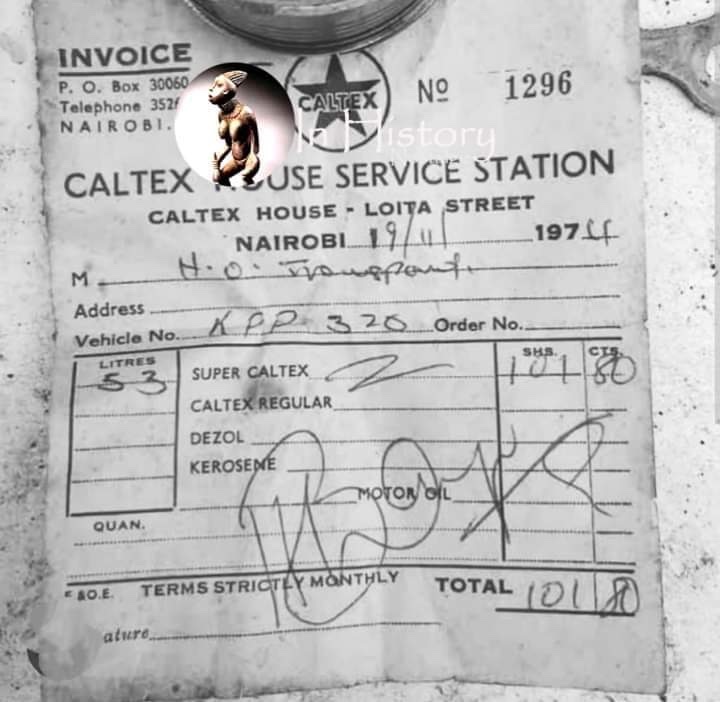

A 1974 fuel receipt shared on social media has not only triggered nostalgic emotions among Kenyans, but also pointed to just how far the Kenya shilling has fallen from over the years. The receipt, dated 19th November 1974, issued by Caltex Loita Street, in Nairobi, indicates at the time Ksh101.80 bought 53 litres of petrol, or just about ksh2 per litre.

About 50 years later, the numbers may not make sense at a time when fuel prices have skyrocketed. Currently, 53 litres of petrol would set you back Ksh11,500, 113 times more than it cost 49 years ago, or up by an incomprehensible 11,275%.

>> How Kenya Airways is Abbreviated as KQ and Not KA

Over the years, the Kenya shilling has lost its value significantly, thanks to inflation which has markedly reduced its purchasing power. What it means is that over the past 50 years the shilling has lost value 113 times more. Basically, Ksh10,000 of today can do much less than it would in those years. Ksh100,000 today would just be Ksh885 of 1994, calculated directly.

But an annual inflation calculator shows the equivalent of Ksh101.80 on 31st January 1974 is Ksh24,324.56 as at 2nd December 2023, representing a mind-numbing inflation rate of 23,794.46%. Today, the same amount of money can buy you 111 litres of the same fuel at 218 per litre, according to analysis by Kamau FX.

Kenyans did not let it pass without a chance to reminisce about the value of the shilling. “In 1970’s, a hundred shillings note was the highest denomination in Kenya and it could do shopping in a supermarket,” says Jesse Kamwaro Gikandi.

Isaac Munyasia noted that raising the Ksh101.80 was no walk in the park those days. “I remember one of my parents working in Nairobi and the salary was Ksh1200.20.”

Ksh101 was a lot of money, says Robert Mariita. “I remember grandfather working at Railways and he used to earn Ksh7 per month. That was the time the shilling was highly valued like the dollar.

“That was good cash,” added Victor Outa. “My grandy bought a plot in old Donholm at Ksh8,000.”

Otieno Mbare says, cheekily: “In 1987 a beer at the Hilton Hotel was sold at Ksh8 and Cider was Ksh25 (it was mostly consumed by ladies!).”

Jeff Njoroge when he was admitted in form 1 in 1974, “tuition fees, school tie caution money and sports fees amounted to Ksh198.00. That was when money was money.”

Inflationary pressures

The prices of commodities, which translate to the cost of living, have been going up over the years, eating at the Kenya shilling’s value. With it has been the weakening of the shilling against major world currencies, especially the US dollar and British Sterling Pound.

That’s why investment experts recommend investing in projects that beat inflation. Land remains one of the options that offer inflation-beating returns.

>> 2023 and 1995 are Same: Calendar Year Repeats Itself

>> How to Reconnect With Lost Wealth in Your Family

Meanwhile, the Kenya shilling has also been losing out big against the dollar, weakening the local currency in the international market. The Kenyan shilling plunged to a historic low of 150 against the U.S. dollar Monday, piling pressure on the country’s dwindling foreign exchange reserves and making imports expensive amid rising inflation.

Shilling in a spiral

CBK projected that recovery in exports, resolution of Russian-Ukraine conflict, pausing of global monetary policy tightening, rise in diaspora remittances, prudent monetary policy and stable import bill are expected to support the local currency to regain stability.

According to the apex bank, the local currency has depreciated over time against major international and regional currencies, exchanging against the sterling pound at a new low of 182.08 shillings and euro at 158.54 shillings Monday.

The country’s inflation rose to 6.8% in September, the first increase since May, from 6.7% in August.

>> Form 4 Leaver Who is Earning Ksh140,000 From Chapatis

![Interior PS Dr Raymond Omollo during a consultative meeting with Japan International Cooperation Agency (JICA) Kenya Chief Representative Shinkawa Makoto. [Photo/Dr Raymond Omollo/Facebook]](https://businesstoday.co.ke/wp-content/uploads/2026/02/Ray-200x133.webp)

Leave a comment