The government has moved to calm investor nerves by saying it was open to discussions on the recently introduced capital gains tax at the Nairobi bourse.

Deputy President William Ruto said that despite President Uhuru Kenyatta signing into law a Bill that will effectively see a 5% tax imposed from January; there was still room for dialogue to address their concerns.

The President appended his signature to the Finance Bill 2014 in September, immediately rousing fears that the tax, which was abolished in 1980’s could affect investment in property, equities, oil and mining sectors. The tax is meant to raise funds for development.

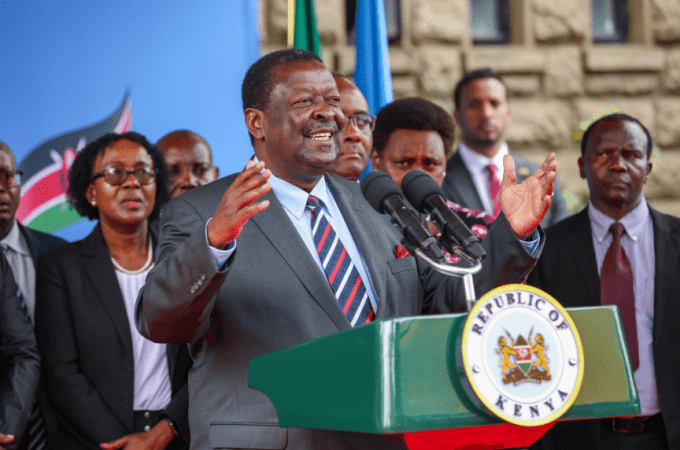

“The government is still open to discussions on charging capital gains tax at the stock exchange,” said Mr Ruto addressing 300 delegates at the 18th Annual Flagship African Securities Exchanges Association (ASEA) Conference.

Analysts fear that the capital gains tax, even though lower than Uganda’s 30% and Tanzania’s 20% could scare away foreign investors leading to an even slower growth pace in an economy that is already weighed down by effects of insecurity around the country.

Mr Eddy Njoroge, Chairman of the Nairobi Securities Exchange (NSE) appealed to stakeholders to work with the government.

He said: “Capital Markets stakeholders have continuously appealed to government to defer the introduction of capital gains tax on transactions to enable the nascent capital markets industry to grow. We urge all capital market players to work with their governments further strengthening the industry while generating development funds”.

Mr Sunil Benimadhu, the Chief Executive of the Stock Exchange of Mauritius and the outgoing President of ASEA, said that Mauritius has deliberately avoided charging a capital gains tax on stock exchange transactions in order to position themselves as an international financial center. Kenya too is leveraging on a recently launched 9-year Capital Markets Master Plan to become an international financial centre.

See: https://businesstoday.co.ke/news/news/1416582897/cma-bets-master-plan-make-kenya-world-financial-hub

Mr Ruto said well-established capital markets can help African countries lessen vulnerability of their economies to external shocks, by locally marshalling funds through instruments such as bonds and reducing currency and duration mismatches.

Mr Njoroge said NSE would continue to work together with other Stock Exchanges to strengthen Kenya’s position as East Africa’s financial services hub.”

Leave a comment