Absa Bank Kenya has received the International Finance Corporation’s (IFC) Excellence in Design for Greater Efficiencies (EDGE) global Certification for integrating green building technologies in accordance with global standards.

The bank, the first in Kenya to receive the award, has invested nearly Ksh45 million in retrofitting its outlets, which include Nkrumah, Kisii, Queensway Branches, Westend HQ, and Bishops Gate Head Office.

Throughout the redevelopment process, the bank’s branches and headquarters saw energy-efficient LED lights refitted, reducing the bank’s carbon footprint significantly. Additionally, the buildings now boast of water efficiency features such as low flow taps, dual or 6-litre flush toilets, low flow urinals and eco-friendly bottle-less water dispensers installed. These investments have reduced Absa’s energy and water costs by up to 30 percent and 33 percent respectively, saving the bank up to Ksh25 million per year.

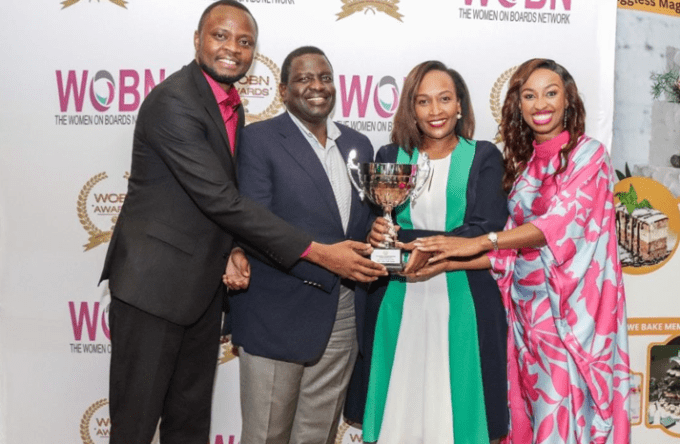

Speaking while receiving the certification on the sidelines of the 2022 East Africa Property and Investment (EAPI) Summit in Nairobi, Absa Bank’s Head of Sustainability, Jane Waiyaki, said the bank is purposefully realigning its business strategies with eco-friendly practices such as greening workspaces for long-term positive impact on the environment, health, and wellbeing of its employees.

“As a responsible business, we are stepping up the efforts to complement the fight against climate change while achieving our goal of becoming a net-zero organisation by 2040. This EDGE Certification is a demonstration of the progress we are making in our sustainability commitment. It also allows us to understand our clients and how we can support them through such a transition,’’ said Ms Waiyaki.

A 2019 report by the International Energy Agency highlights the building and construction sector as a key contributor to greenhouse gases accounting for 40 percent of energy-related carbon emissions and more than one-third of energy consumption globally. Green buildings thereby ensure reduced carbon emissions by adopting environmentally responsible practices and resource-efficient practices throughout a building’s life cycles – financing, planning, design, construction, operation, maintenance, renovation, and demolition.

“Adoption of green building technologies across our facilities aligns with sustainable development goals (SDGs) on good health and wellbeing, affordable and clean energy, sustainable cities, and communities as well as responsible production and consumption. As a bank, we remain focused on building a sustainable environment that safeguards and contributes to the prosperity of stakeholders and communities we operate in,” added Ms Waiyaki.

On her part, IFC’s Head of Global Operations Corinne Figueredo said: “We are honoured to have Absa as a partner striving for a change in the building market. The EDGE certification is growing exponentially in Africa, and with partners like Absa we can only see a promising future in the promising future with accelerated adoption of green building technologies.”

In 2020, Absa Bank Kenya became the first financial institution to join the Kenya Green Building Society (KGBS), a non-state actor seeking to lead the transformation of the built environment in Kenya towards environmentally sustainable buildings, promoting a healthy and efficient built environment to achieve environmentally, socially and economically progressive built environments.

The bank is also a signatory to Principles for Responsible Banking at a group level and signed up to the United Nations Global Compact (UNGC) principles through the Global Compact Kenya Network locally.

Read: Medical Practitioners To Get Upto Ksh10M Unsecured Loans In Absa, KMA Partnership

Leave a comment