The Kenya Revenue Authority (KRA) has rolled out the electronic Tax Invoice Management System (eTIMS), which is set to make tax filing and remission easier for businesses.

The eTIMS is set to complement the existing Tax Invoice Management System (TIMS), which is handled through Electronic Tax Register Machines, popularly known as ETR machines. The upgrade of TIMS will enhance the efficiency of transmitting electronic invoices to KRA on a real-time basis. The new eTIMS system will enable VAT-registered businesses to connect their accounting system to KRA without the need to buy expensive ETR TIMS devices.

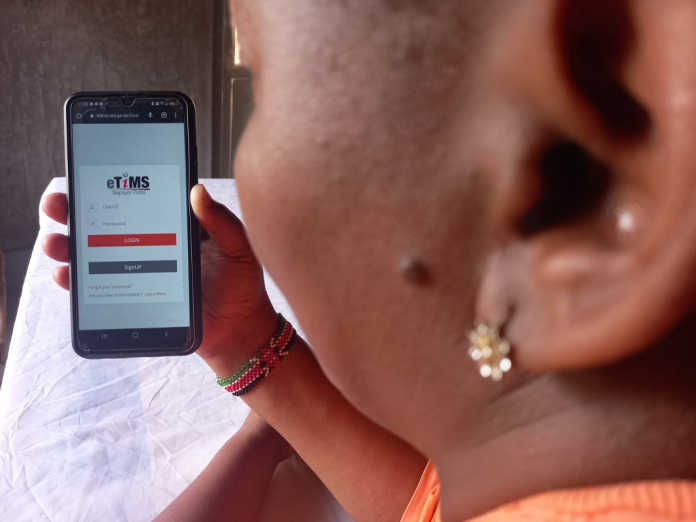

The system went live on 1st February, 2023. “eTIMS is the software version of the Tax Invoice Management System which provides additional ways of transmitting invoices to KRA on real time basis. The software will be provided to taxpayers by KRA at no additional cost,” KRA describes the system.

According to a statement by KRA board Chair, Mr Anthony Mwaura, on 23rd January 2023, there are 106,600 VAT taxpayers in Kenya and only 61,000 were registered with TIMS. KRA says this upgrade will significantly enhance the experience of taxpayers in managing tax invoices.

eTIMS available on multi-platforms

This latest version will be available through four channels, providing tax payers with convenient ways to issue tax invoices and have them transmitted to KRA in real-time. The options include an online portal, client version that can be used on laptops/computers or tablets, a mobile application, and an application that facilitates integration with existing billing systems.

Instead of using the traditional ETR machines, the new system allows businesses to use desktop or laptop computers, tablets, Virtual Sales Control Units (VSCU) and mobile phones. According to a statement released by KRA on 27th February, the online portal will enable Tax Payers to issue tax invoices and have them transmitted to KRA in real-time. eTIMS will thus facilitate electronic tax invoice management through standardisation, validation, and transmission of invoices to KRA. Offers faster processing of VAT refunds, pre-filled VAT return, and non-intrusive verification of tax matters.

Automates tax invoice processing

The system, which is already in use in Rwanda, is set to fully automate the tax invoice process and improve compliance, ultimately increasing revenue collection. Currently, Kenya’s Tax to GDP ratio stands at 15.3% with VAT accounting for 4%, while Rwanda’s tax to GDP ratio is 16.9% with VAT accounting for 7%.

The eTIMS system incorporates a Supply Chain Module (SCM), which manages the taxpayer’s inventory thus providing visibility to taxpayer transactions from the point of acquisition to the point of sale.

What happens to ETR Machines?

KRA says those with the TIMS ETR devices will continue to be in use until advised to migrate fully into eTIMS. Roll-out of eTIMS will be done through a phased approach.

“The objective of eTIMS is to reduce the cost of compliance for VAT registered businesses. Through integration with eTIMS businesses will benefit from real time invoice transmission providing accuracy in tax invoice declarations and reconciliation between filed returns and payments. This will also eliminate the need for multiple hardware purchases,” KRA says.

eTIMS is open for use by VAT registered taxpayers facing challenges in onboarding TIMS, taxpayers dealing in bulk invoicing and facing capacity/performance issues with invoice transmission and VAT registered taxpayers facing challenges integrating with ETR devices.

It will assist VAT-registered small, and large-scale businesses to reduce the cost of compliance, and benefit from real-time invoice transmission providing accuracy in tax invoice declarations and reconciliation between filed returns and payments.

Who is targeted?

KRA urges taxpayers who have been paying VAT but are not compliant to e-invoicing requirements to transition to the upgraded eTIMS system. Taxpayers whose businesses have no computers can use the mobile application to submit invoices. It is also open to volunteer taxpayers.

Taxpayers should have a device that can transmit invoices to KRA systems with stable internet connectivity. Businesses can download the eTIMS software from the KRA website and sign in at the eTIMS portal.

Visit the nearest KRA office to sign up.

Next Read >> Meet The Little Known CEO Running Equity Bank In Kenya